Obtaining a loan for your small business may seem daunting at first, but it will be much easier if you’re prepared going into the application process. Here’s how to get a small business loan in six simple steps.

1. Determine how much money you need

It may seem obvious that you should determine how much money your business needs before you start looking for a loan, but don’t skip this step for three reasons:

- 1. The bigger your loan, the more you will pay toward interest. Your loan is an interest-bearing debt that will weigh on your balance sheet. You want to pay off your loan as efficiently as possible. The more you pay toward the principal, the quicker that loan will disappear from your business liabilities.

- 2. Lenders make money on your interest payments. Accordingly, lenders want you to pay interest for as long as possible. If you know how much money you need before you talk to the lender, the less likely you are to fall victim to a lender convincing you to take out more money than you need.

- 3. Loans affect your credit score. Too much debt negatively impacts that score. The less debt you take on, the less likely the loan will bring down your credit score.

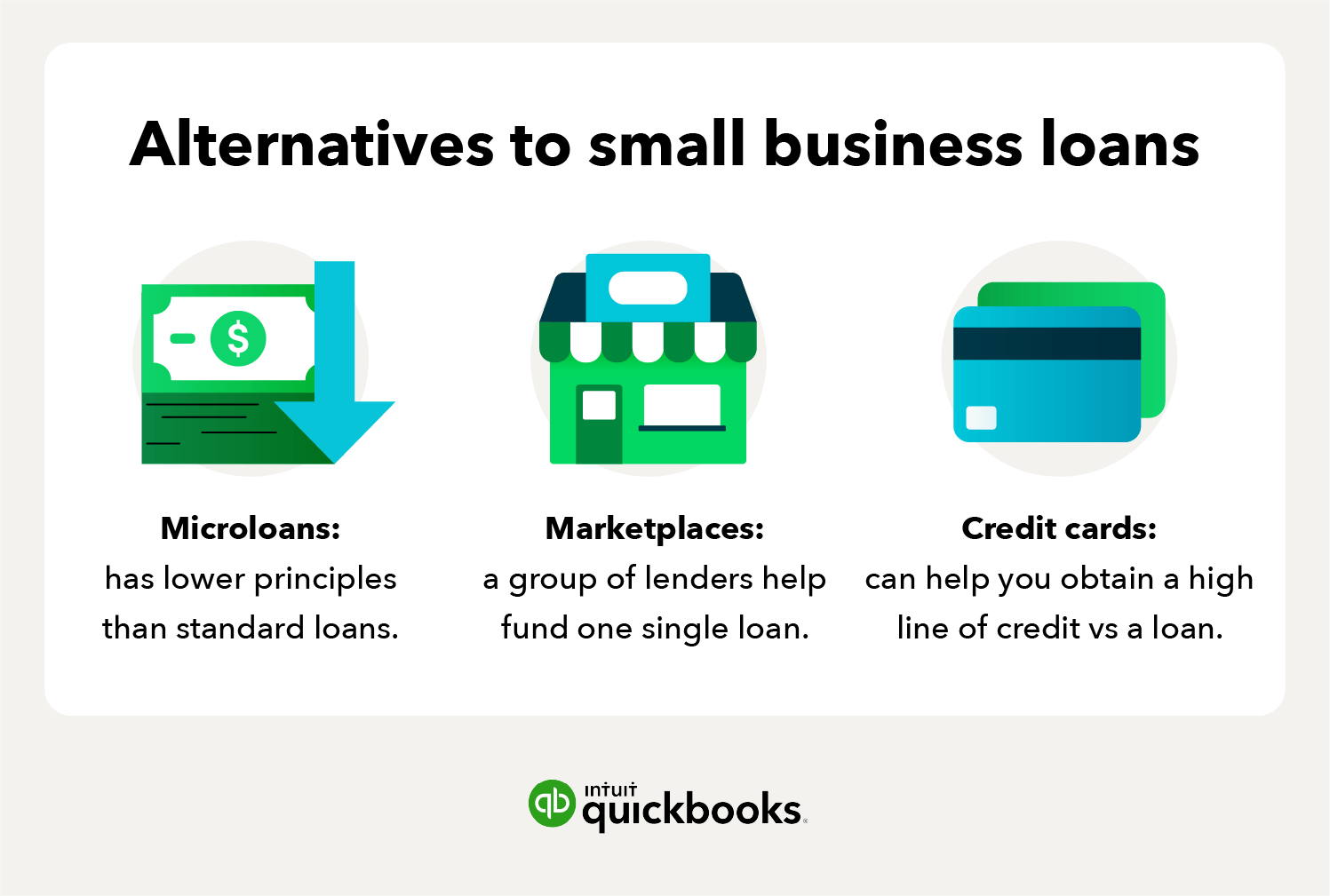

2. Decide if a loan is the right method

Before jumping into debt, consider your other options. Would it be better for your business to add an additional owner in exchange for equity capital?

Instead of taking on a loan to higher additional employees, is it possible to outsource the work to a freelancer and avoid the need for the loan? In other words, make sure a loan is the right fit for your business before committing to a debt financing strategy.

3. Select the type of loan that fits best

As mentioned, there are plenty of loan options for your business, but how do you determine which one is the right fit? Review each loan and consider these factors below to determine suitability for your business:

- Qualifications: Take a look at the loan qualifications to see if your business qualifies.

- Restrictions: If you qualify, review any restrictions that might apply to the loan. If restrictions disallow you from applying the funds as your business needs, the loan is not a fit.

- Interest rate: As a borrower, it’s important to look at the interest rate and the term to see if you can afford the loan.

- Loan terms: Review the loan terms for any early pay penalties that may apply in the event that you can pay off the loan before the end of the term. Remember, lenders make their money on interest!

- Impact on credit: Finally, consider the impact of the loan on your business credit score. Some debt can improve your credit rating, but too much debt will pull that number down.

4. Review the lenders available

Once you land on a loan type for your business, find applicable lenders. Think of your business as a customer during this process. Shop around. Play one lender against another, and search for the best deal possible.

Because lenders make their money on interest when it comes to small business financing, they may not offer you their best rate at introduction. Don’t be offended by this. Push back. Let the lender know that you are shopping their rates and terms against competitors.

A word of caution as you shop lenders: If you give a lender permission to check your credit score, the check will show up on your credit report. You don’t want your credit score checked too often in a short amount of time. Get as many details as possible from a potential lender before you give them permission to check your credit score.

5. Review each lender’s requirements

Once you have narrowed down the list of lenders, make sure you understand their requirements before applying. For example, most lenders require collateral to secure the loan.

In the legal documents you fill out to finalize the loan, you will offer your business collateral as the backup. If you don’t pay the loan, the lender has the right to seize your collateral, and then sell the collateral to repay the loan.

In the event that a lender is not satisfied with your business collateral, they may require you to find a cosigner with better collateral. In this case, you want to find a cosigner before the loan documents are ready for signing.

Understand collateral minimums and any other loan requirements early in the process. Give yourself time to determine what risks you are willing to take to secure your loan.

6. Collect information

The documents required to secure a loan vary from lender to lender and are based on your business history. Some of these documents include:

- Balance sheets with recent financial and tax return statements

- A written business plan

- Business credit history

- Personal financial information

- Contact information

If your business carries enough cash to cover the entire loan, you likely won’t need much more than a balance sheet and some recent financials. However, the fact that you are considering a loan probably means you don’t have that much in your bank account.

In this case, you will need a few years of business financials, a written business plan, your business credit history, personal financial information, contact information, references, and possibly more. Lenders to specific industries also want proof of your specialty.

The more business information you have available, the more prepared you will be. If specific licenses, qualifications, or permits tailored to your business exist, have associated documentation ready for review when you apply for a loan. Using accounting software like QuickBooks can help you automate business recordkeeping and generate reports like the balance sheet.

7. Apply for your small business loan

Once you have narrowed down the loan type for your business and determined you are qualified, it’s time to apply. If you’ve followed the steps in this article and prepared the information above, it should be as simple as bringing everything together.