As a small business owner, knowing which accounting practices you should use can be confusing. However, you must remember the fundamental accounting principles for your business’s finances. One crucial fundamental principle is double-entry bookkeeping.

Double-entry bookkeeping is an important concept that drives every accounting transaction in a company’s financial reporting. Business owners must understand this concept to manage their accounting process and to analyze financial results. Use this guide to learn about the double-entry bookkeeping system and how to post accounting transactions correctly.

While bookkeeping refers to the day-to-day journal entries of a business, and accounting uses the information in those journals to create reports, when used in relation to the double-entry system, it’s often called either double-entry bookkeeping, or double-entry accounting.

What is double-entry bookkeeping?

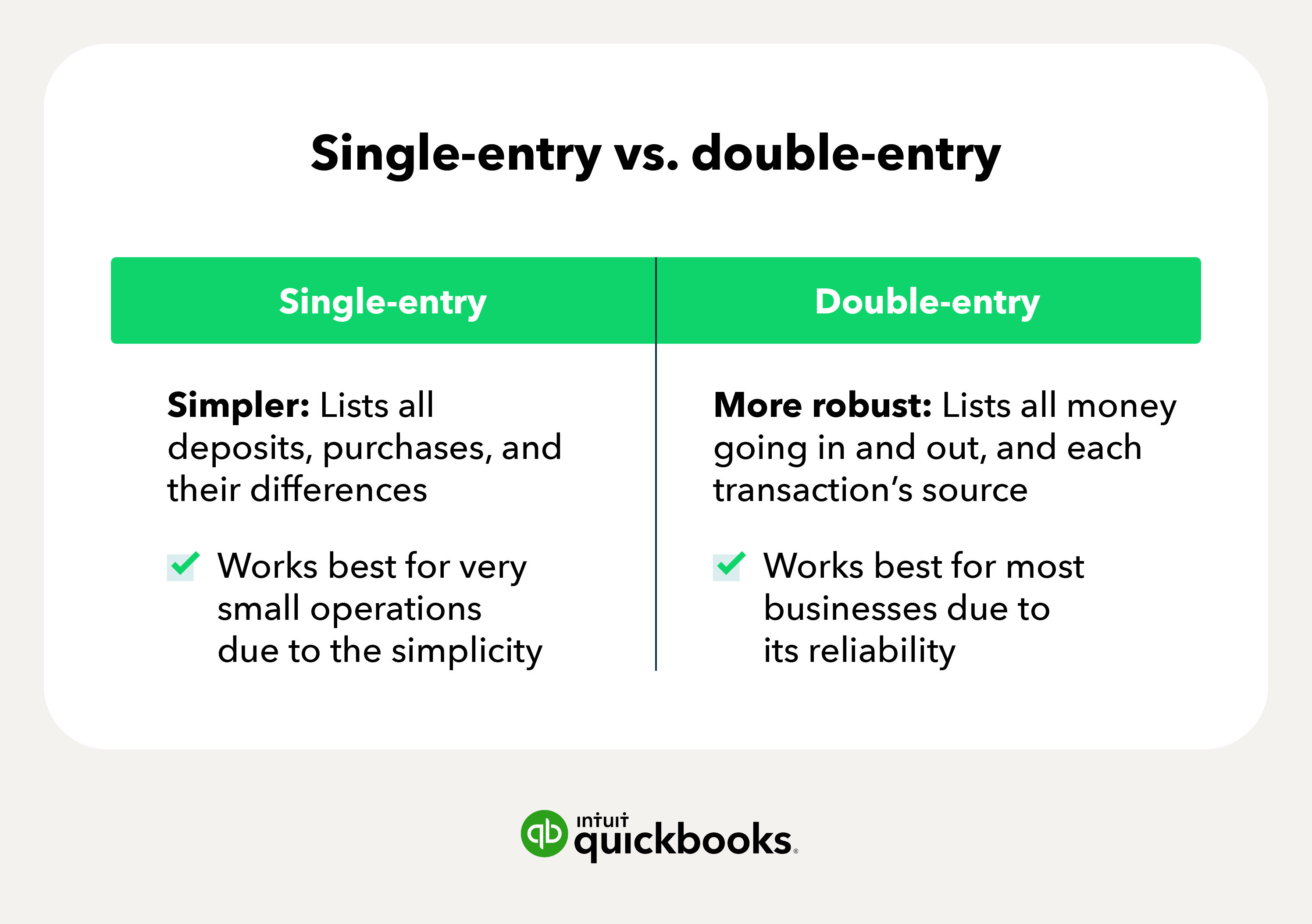

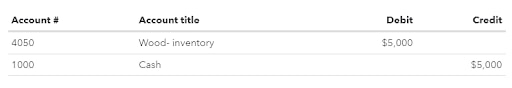

Double-entry accounting is the standardized method of recording every financial transaction in two different accounts. For each credit entered into a ledger there must also be a corresponding (and equal) debit.

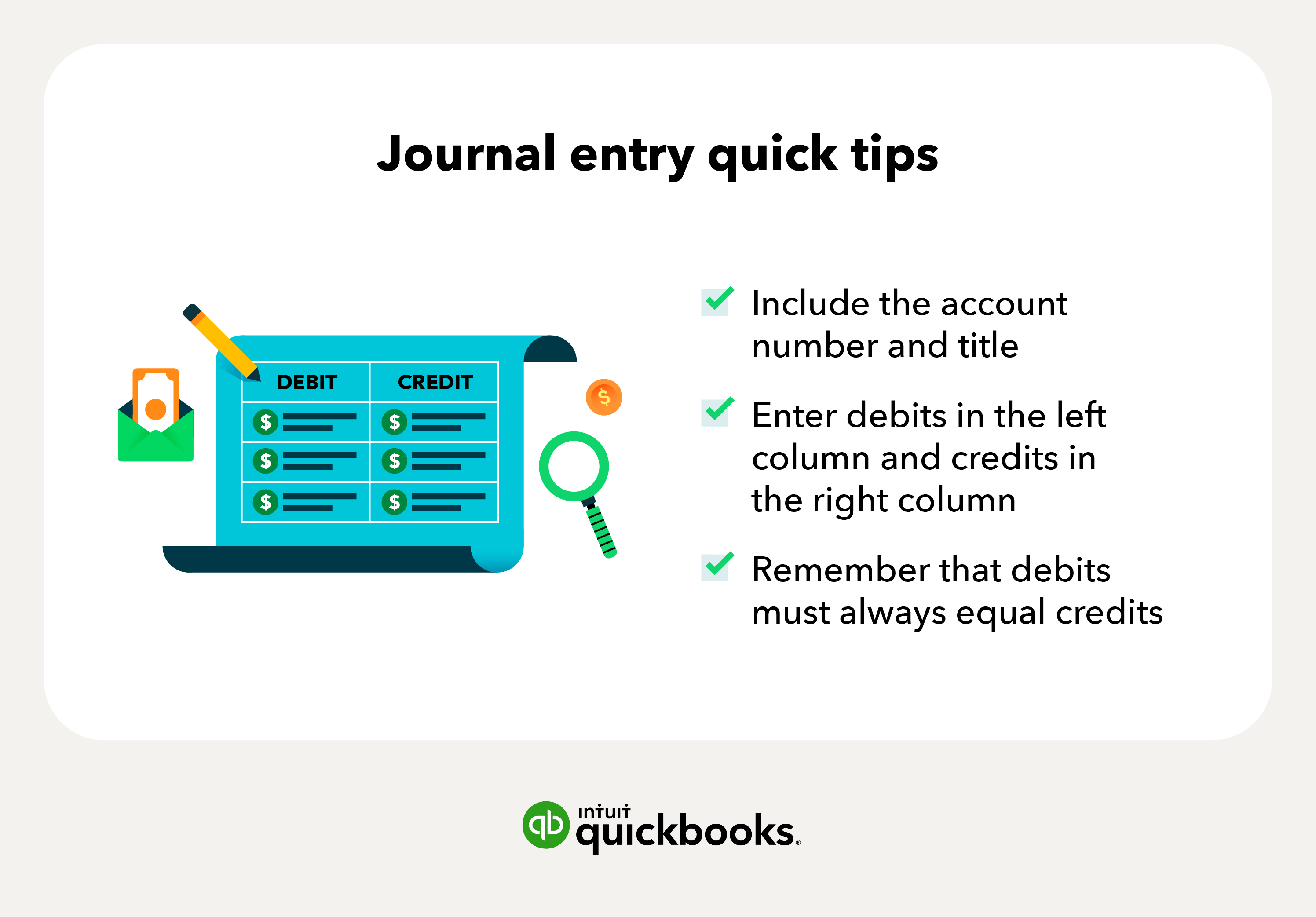

The term “bookkeeping” refers to a business’s record-keeping process. A bookkeeper reviews source documents—like receipts, invoices, and bank statements—and uses those documents to post accounting transactions. If a business ships a product to a customer, for example, the bookkeeper will use the customer invoice to record revenue for the sale and to post an accounts receivable entry for the amount owed.

When entering business transactions into books, accountants need to ensure they link and source the entry. Linking each accounting entry to a source document is essential because the process helps the business owner justify each transaction.

Bookkeeping supports every other accounting process, including the production of financial statements and the generation of management reports for company decision-making.

Why is double-entry bookkeeping important?

Double-entry bookkeeping is the standard method of accounting, and using it provides a number of important benefits:

- Provides a clear view of your company’s financial health

- Allows you to spot and resolve errors quickly

- Helps identify profitable and unprofitable aspects of business

- Snapshot of your business that banks and investors can easily understand