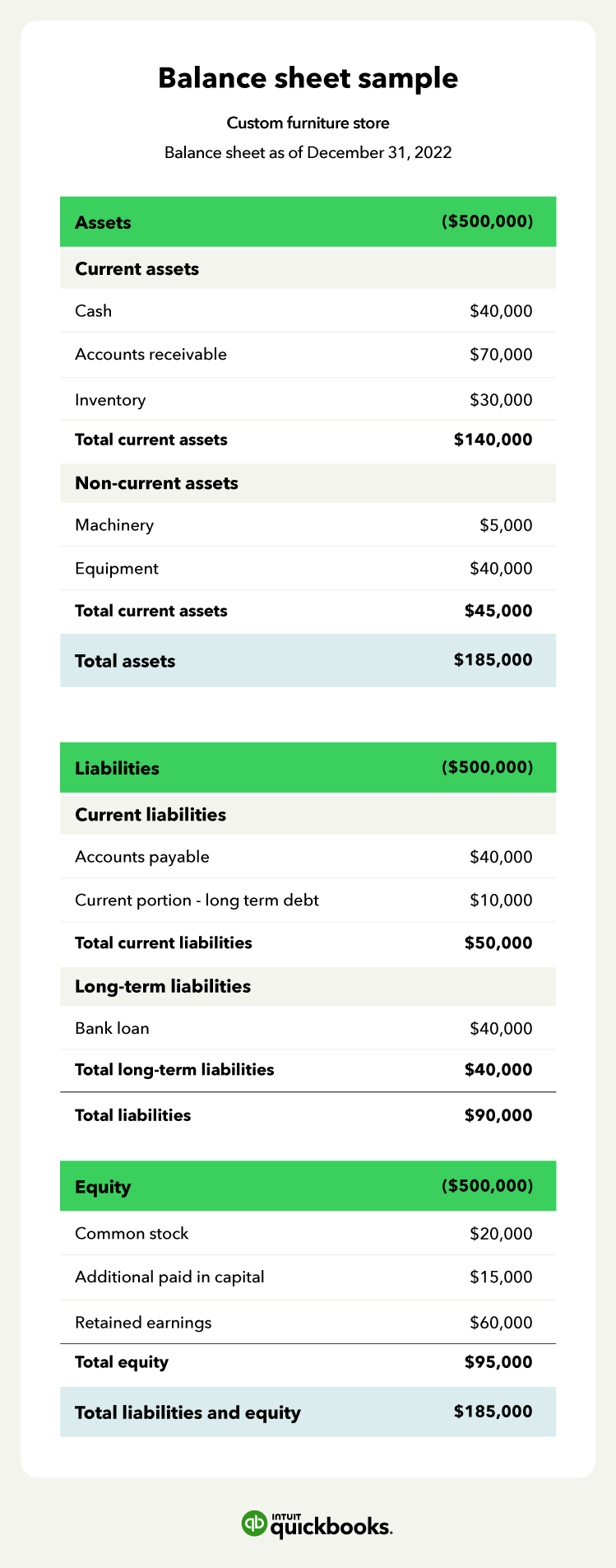

Use a balance sheet to calculate retained earnings

The next step to figuring out your retained earnings balance is using a balance sheet. Essentially, a balance sheet equation looks like this:

Assets = liabilities + equity

Accountants use the formula to create financial statements, and each transaction must keep the formula in balance. This bookkeeping concept helps accountants post accurate journal entries, so keep it in mind as you learn how to calculate retained earnings.

Here is an example of how the balance sheet equation works:

Let’s say a business issues a $10,000 bond and receives cash. The company posts a $10,000 debit to cash (an asset account) and a $10,000 credit to bonds payable (a liability account).

The company records that liabilities increased by $10,000 and assets increased by $10,000 on the balance sheet. There is no change in the company’s equity, and the formula stays in balance.

If every transaction you post keeps the formula balanced, you can generate an accurate balance sheet. Note that each section of the balance sheet may contain several accounts.

Classifying assets and liabilities

- Current assets: Cash and other assets that you expect to convert into cash in 12 months are less, including accounts receivable and inventory balances

- Current liabilities: Liabilities that you must pay in cash within a year, including accounts payable

- Working capital: Current assets minus current liabilities. To finance short-term obligations, successful businesses maintain a positive working capital balance.

As you work through this part, remember that fixed assets are considered non-current assets, and long-term debt is a non-current liability.

Understanding the equity section of a balance sheet

If a business sold all of its assets and used the cash to pay all liabilities, the leftover cash would equal the equity balance. This is why equity is a company’s real value. When one company buys another, the purchaser buys the equity section of the balance sheet.

Shareholder’s equity section includes common stock, additional paid-in capital, and retained earnings.

- Issuing common stock: Par value is a dollar amount used to allocate dollars to the common stock category. Custom Furniture’s common stock balance is $20,000.

- Posting additional paid-in capital: Additional paid-in capital is the amount of money shareholders invest greater than the common stock balance. The additional paid-in capital balance is $15,000.

Balance sheet sample

Now that you’ve learned how to calculate retained earnings, accuracy is key. The purpose of a balance sheet is to ensure all your bookkeeping journal entries are correct and every penny is accounted for.

Here’s a detailed example of a completed balance sheet: