1. Choose a business structure

Your business structure is the foundation of your business, including how your taxes are filed, how personal assets are handled, and how day-to-day operations are controlled. It also impacts business registration, including how and who you register with. There are many types of business structures, so it’s important to choose the one that best suits your organization's needs.

The most common business structures include:

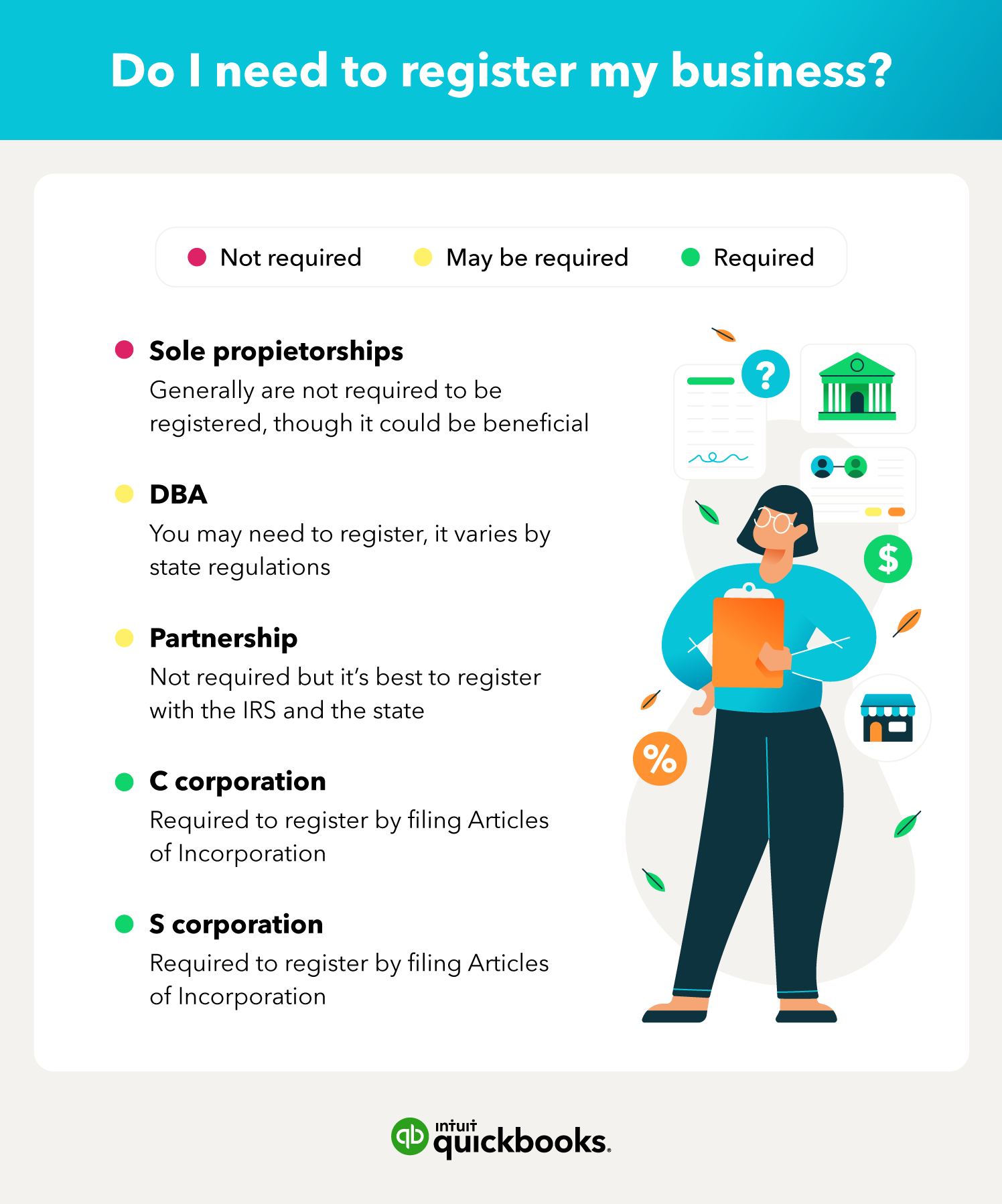

- Sole proprietorship: This is the most common type of business designation. It doesn’t require formal registration, however, you may still need to obtain the necessary licenses and permits which can vary by industry and state. As a sole proprietor, you use your own name to conduct business and use your Social Security number as your tax ID number.

Key takeaway: This is what your business structure will be considered by default if you don’t pick one of the other options.

- DBA: “Doing business as” simply allows sole proprietors to operate under a name other than their own. For example, if John Smith started a plumbing business, he could file to do business as Smith Plumbing. The DBA designation, like any sole proprietorship, doesn’t offer the liability protection of other business designations, but it’s still valuable for marketing and credibility purposes.

Key takeaway: It’s similar to a sole proprietorship, however, operates under a name other than your own.

- Partnership: A partnership is a business with two or more owners. The most basic type of partnership is a general partnership, in which owners divide all profits and liabilities equally. In addition to a general partnership, other types of partnerships include:

- Limited partnership: In this type of partnership, one partner has liability exposure, while the other has limited liability.

- Limited liability partnership (LLP): In such a partnership, all business owners are safe from the debts of the business.

Key takeaway: If you co-own a business, you’ll likely have a partnership business entity.

- Limited liability company (LLC): An LLC combines the simplistic tax laws of a partnership with the limited liability protection of a corporation. An LLC can have one or more owners, referred to as “members”. As a member of an LLC, you file taxes as if you were a sole proprietor or partner: All of your business income and deductions pass through to your personal tax return. However, the LLC is a separate entity, so members can’t be held personally responsible for the company’s debts or liabilities.

Key takeaway: LLC status separates personal assets from business liability.

- C corporation: These are reserved for medium to large businesses. A C-corp’s income is reported on a separate tax return—and owners, or “shareholders,” are taxed separately. Shareholders hold stock in the company, and formal company proceedings (such as electing a board of directors and assigning board duties) are required. C-corps have tax advantages that other entities do not, but they are more expensive to set up and more complicated to run.

Key takeaway: C-corps are more complicated to run and have different tax advantages than other types of business structures, making this a better option for larger businesses.

- S corporation: Like C-corps, S-corps offer limited liability protections, however, an S-corp is taxed more like a partnership or sole proprietorship. In other words, income passes through to the shareholders’ personal tax returns. However, the IRS is more likely to closely monitor S-corps’ taxes, and tax mistakes can even result in the termination of your S-corp.

Key takeaway: S-corps are taxed in a similar fashion to sole proprietorships and partnerships, with the limited liability protection of a C-corp.