How to accept electronic payments

Given today’s technology, accepting electronic payments is relatively simple. However, here are some of the things you’ll need:

- Sign up for a merchant account: If you plan on accepting card payments you’ll likely need a merchant account. Start by talking to your current bank about merchant account options for your business. You’ll also want to ask your bank about accepting ACH payments and if there are any fees associated with that.

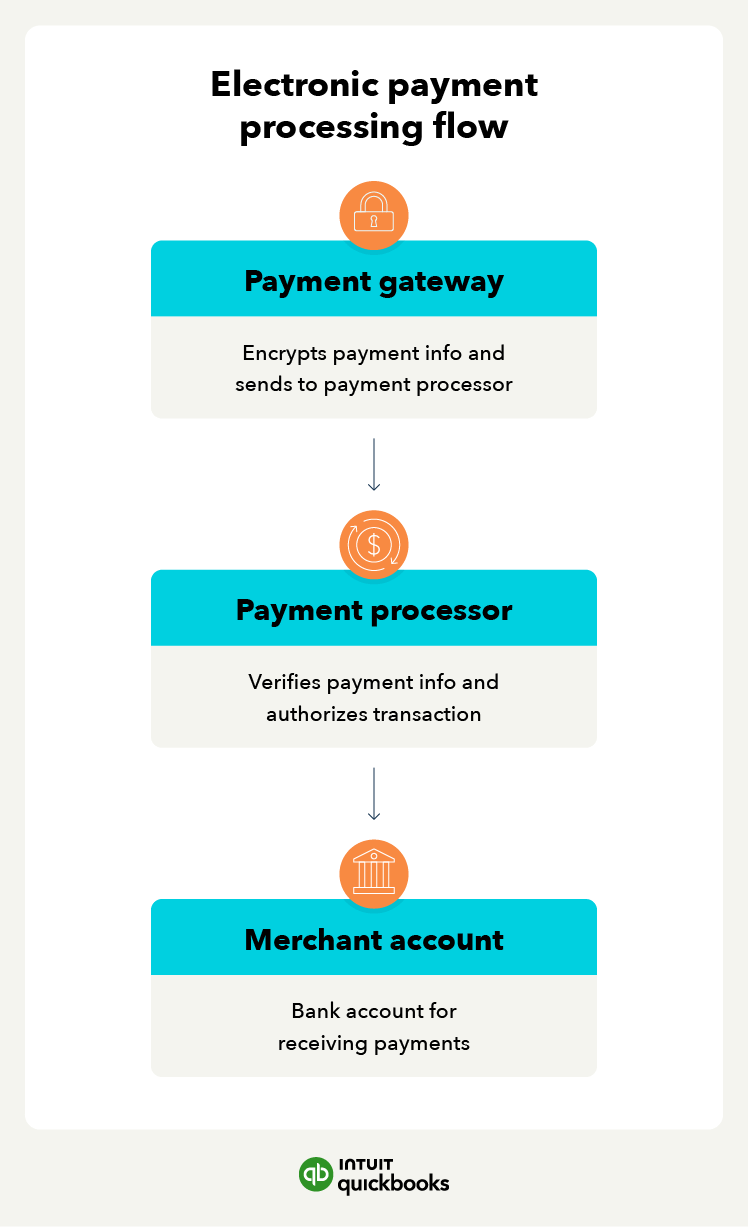

- Get the correct tools: You’ll need a payment gateway and a payment processor. Remember that many platforms combine both of these tools into one easy-to-use solution, including QuickBooks.

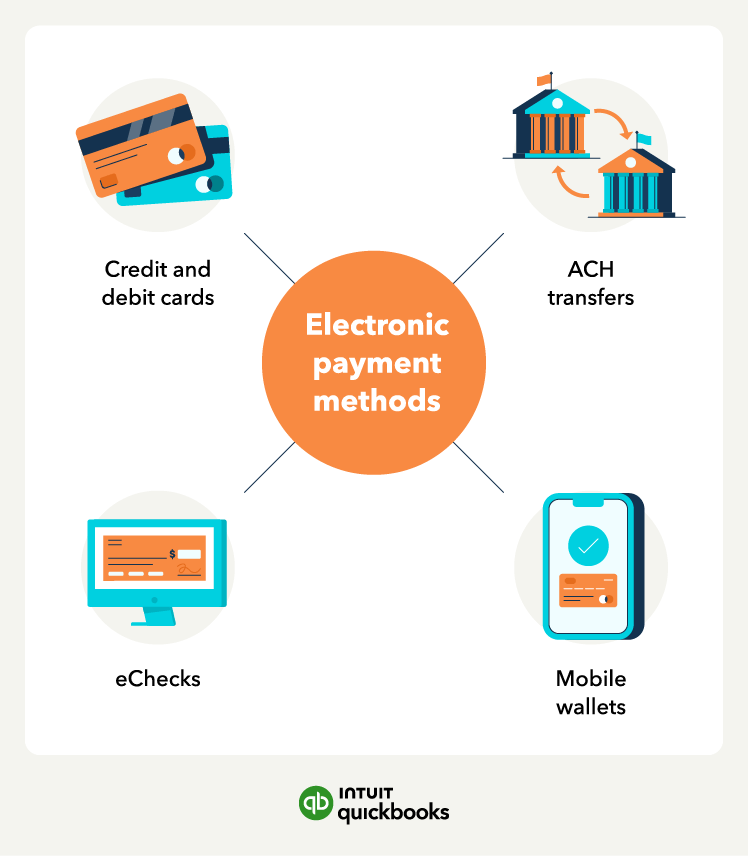

- Include e-payments in your checkout process: Once you have those core elements set up, you need to give customers the option to pay electronically. Depending on your type of business, this might include: Adding a card reader to your POS system so you can accept e-payments in person, creating an online storefront with the option to accept various types of e-pay methods, using an invoicing tool that lets you enable different electronic payment methods.

When it comes to accepting electronic payments, many business owners understandably want to know how long they need to wait to get their money. The answer depends on the type of electronic payment that’s being processed.

With all four e-payment types, they aren’t instantaneous, so make sure to keep that in mind as you manage your cash flow.

Benefits of e-payments

Using e-payments, especially in your small business, comes with key advantages, including

Convenience and efficiency

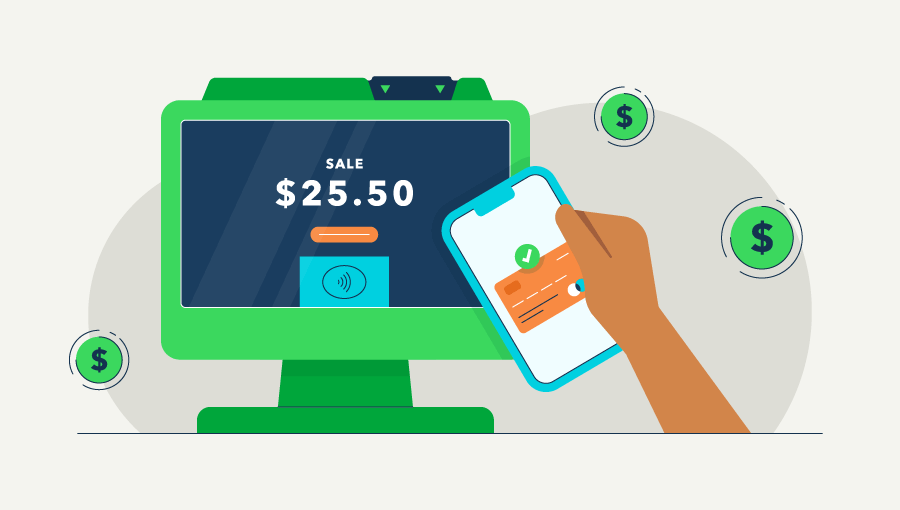

Electronic payments are quick and easy for the customer. On the business side, electronic payments are easier for you as well. If you route those payments through your point-of-sale system or platform that integrates with your accounting software, you can simplify your bookkeeping and reduce manual data entry.

If you run a physical store or location, electronic payment systems also offer shorter checkout lines. With the ability to make payments electronically, customers can swiftly complete transactions. Embracing electronic payment methods can improve business operations and enhance the overall customer experience.

Potentially higher revenue

You’ll need to cover some processing fees when accepting electronic payments, but even with that additional expense, offering these payment methods can help boost sales. For example, customers might be willing to spend more when they can pay with a credit card. Overall, e-payments mean more payment options for your customers.

One key aspect of electronic payments is the ability to set up recurring payments—with customer consent. By automating transactions through electronic payment systems, businesses can ensure timely payments without relying on customers to remember to make manual payments. This reduces the risk of missed or late payments and can improve customer retention.

Better customer relationships

More than ever, customers want options. That applies to payment options and choices between brands, products, and services. By embracing electronic payment methods, businesses can enhance the overall experience for their customers while fostering trust and reliability.

Requiring your customers to use a certain payment method can lead to a negative customer experience. Meanwhile, customers may appreciate the ease and speed of making payments electronically.

Choose the best payment setup for your business

When looking for the best payment methods for your small business, be sure to look for options that integrate easily with your business. Note that some businesses charge monthly fees for integrations, while some only charge per transaction.

For example, if you have an online business, look for payment processing options like QuickBooks Payments that have no mothy fees and integrate with today’s e-commerce platforms—while also getting other key e-pay features, such as mobile card readers and “pay now” buttons right on your Invoices.3