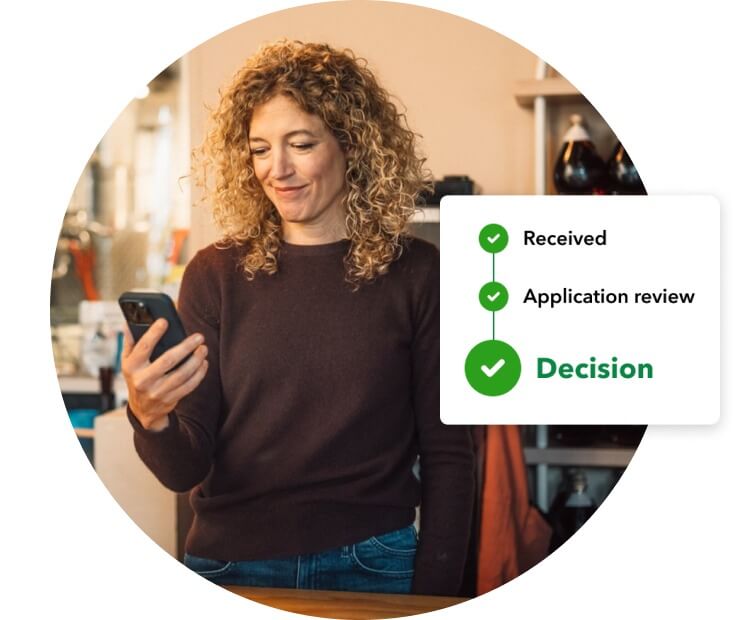

98% of customers are satisfied with the speed of the decision.1

A simple, transparent process

Access a QuickBooks Term Loan with no origination fees, prepayment penalties, or hidden charges.2 Your clients know where they stand at every step.

Apply in QuickBooks

Save time—it only takes minutes to apply and get a decision.

Get flexible terms

Loans from $1.5K–$200K with terms from 6–24 months.

Access competitive rates

Business loans with no origination fees or prepayment penalties.2

Explore lending options

Infuse additional capital into your business for things like fueling growth, covering expenses while awaiting payment, or boosting your cash flow.

Customers don’t always pay immediately. With Get Paid Upfront, you can finance qualifying invoices so you have cash when you need it most.

Browse additional funding options through QuickBooks Capital’s partners that provide small business loans and lines of credit.

Business eligibility

Here are a few things used to determine if a business is eligible for a QuickBooks Term Loan:

- Up-to-date and accurate business data in QuickBooks

- Primary business bank accounts connected through QuickBooks (not required)

- Generally, revenue of at least $50,000 over the past 12 months

Why small businesses rely on QuickBooks for access to capital

“It’s such a simple, easy process—from applying to getting funded. I’ve used their services many times and they have earned my continued business.”

Kevin

Contour Balance, LLC.

September 2022

“QuickBooks is an easy, non-discriminatory, and most efficient source of capital...Very helpful! Would 100% recommend.”

Gabby

Palladium Patios and Landscaping LLC

March 2023