Making Tax Digital for VAT applies for nearly all VAT-registered businesses

- Software with you in mind

- QuickBooks for accountantsSupporting you and your clients

- Pricing for accountantsWhatever your practice needs, there's a plan for you

- Client onboardingWe'll get them up and running

- MailchimpThe perfect partners for your practice

- Be found by new clientsIn our Find-a-ProAdvisor directory

- Referral programmeBoth get £100 in Amazon vouchers

Become a ProAdvisorJoin our free ProAdvisor Programme and access tools, resources and exclusive discounts to help take your practice to the next level. - online Accounting for sole traders

- QuickBooks for sole tradersEverything you need to know

- Pricing for sole tradersWhatever your business needs, there's a plan for you

- Onboarding as a sole traderSet yourself up for success

- Switch to QuickBooksMove to us from another solution

- Find an accountantSupport from a QuickBooks certified accountant near you

- IndustriesOur accounting software is designed for every industry. Find yours here

- Discover QuickBooksSee why over 6.5 million subscribers worldwide choose us

- QuickBooks Self-employedSoftware for sole traders not registered for VAT

- QuickBooks OnlineOur range of simple, smart accounting software solutions

- Connect appsSeamlessly connect 300+ apps to QuickBooks

features for sole traders - Grow your business

- QuickBooks for limited companiesEverything you need to know

- Pricing for limited companiesWhatever your business needs, there's a plan for you

- Onboarding as a limited companySet yourself up for success

- Switch to QuickBooksMove to us from another solution

- Find an accountantSupport from a QuickBooks certified accountant near you

- IndustriesOur accounting software is designed for every industry. Find yours here

- StartupsGrow your business from day one with QuickBooks

- Discover QuickBooksSee why over 6.5 million subscribers worldwide choose us

- QuickBooks OnlineOur range of simple, smart accounting software solutions

- QuickBooks AdvancedDiscover our most powerful plan yet, made for growing businesses

- Connect appsSeamlessly connect 300+ apps to QuickBooks

- Plans & Pricing

- Talk to us: 0808 168 9533

- How can we help you today

- QuickBooks support hubWe're here to support you through every step

- Getting startedEverything you need to get set up for success

- Desktop to OnlineHow to switch from QuickBooks Desktop to QuickBooks Online

- Discover QuickBooksSee why over 6.5 million subscribers worldwide choose us

- Switch to QuickBooksMove to us from another solution

- QuickBooks OnlineOur range of simple, smart accounting software solutions

Invoices & expensesBanking & Payments - Sign in

MTD bridging software for VAT | QuickBooks for accountants

Making Tax Digital software for spreadsheet clients

Making Tax Digital (MTD) rules are changing. Help your clients comply, with MTD bridging software from QuickBooks - a flexible solution for spreadsheet users and businesses with complex VAT needs. Then you can move them to the cloud whenever they’re ready.

If you’re a sole trader or small business owner, explore QuickBooks’ software for making tax digital.

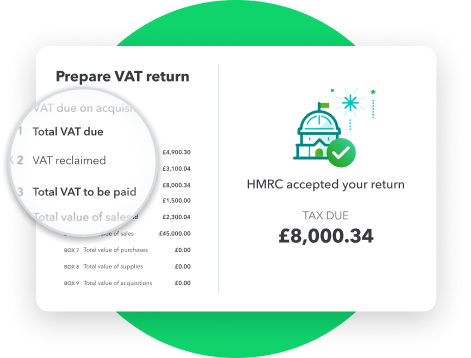

MTD-ready

HMRC recognised

The all-in-one solution for Making Tax Digital

Take the pressure off

Do your clients love their spreadsheets? No problem. Keep them compliant without the need to change how they do things.

Offer a flexible solution

The 9-box VAT summary creates the final digital link between your clients' spreadsheets and HMRC.

Support all your clients in one place

QuickBooks’ bridging software is included in our cloud-accounting software subscription at no additional cost.

Get ahead of the deadlines

Soon, almost all small businesses will need to comply with Making Tax Digital for VAT. That means even those who use manual methods like spreadsheets will need to submit their returns to HMRC using digital links. Be confident that all your clients are MTD-ready ahead of the following deadlines.

Making Tax Digital for Income Tax applies to self-employed businesses and landlords with annual business or property income above £50,000

Making Tax Digital for Income Tax applies to self-employed businesses and landlords with annual business or property income above £30,000

Changes to corporation tax are likely to follow in due course.

Submit VAT effortlessly

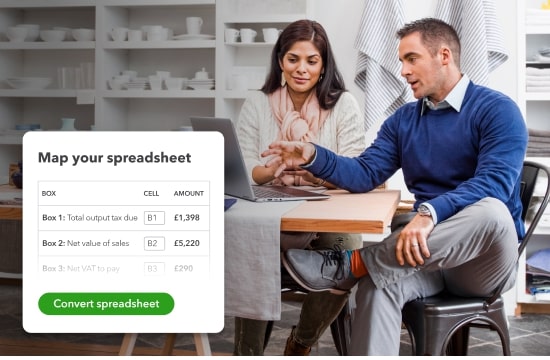

QuickBooks’ MTD bridging software helps your spreadsheet clients comply with Making Tax Digital without changing the way they manage their VAT. You can get started in two simple steps.

- 1. Register your clients for MTD with HMRC.

- 2. Upload your clients' VAT returns in QuickBooks. All we need is a 9-box summary.

- 3. Submit VAT returns to HMRC.

See how easy it is to submit VAT from Excel or other spreadsheets

QuickBooks: Your partner for Making Tax Digital

QuickBooks Online Accountant can help you grow your practice, save money and free up your time so you can focus on supporting your clients. Join our community and enjoy these benefits:

MTD training for accountants

QuickBooks for accountants provides you with the resources you need to be ready for Making Tax Digital. Take advantage of free QuickBooks training to learn how to prepare for the next phase of MTD for VAT.

Introductions to new clients

Publish your profile on our directory of accountants, where thousands of small businesses go to find professional support.

MTD marketing materials

Join our free ProAdvisor programme to access MTD marketing materials that will help you grow your practice.

Free onboarding support

Getting set up with QuickBooks is easy - we’re here to help every step of the way. Book a consultation to get free onboarding support from our dedicated team of specialists.

Discounted rates for your clients

Get discounted QuickBooks Online subscriptions to offer to your clients. Get in touch with a member of the team to learn more.

What accountants and bookkeepers say about us

"QuickBooks is an all in one solution for my firm AND for my clients."

Thabo A., Partner.

Review Source: SourceForge

"Practice management tools are great and free to us accountants."

Gaby S., Owner and Principal

Review Source: G2

"QuickBooks Online is as yet the best web based bookkeeping application for independent ventures."

Myint M., Accountant.

Review Source: Capterra

Free bridging software with every QuickBooks Online subscription

Bridging software for VAT is available for every one of your clients as part of their QuickBooks Online subscription.

QuickBooks Online Accountant

The QuickBooks dashboard costs nothing for accountants and bookkeepers working in practice.

FREE

Only pay for adding clients

Try QuickBooks for FREEor call 0808 168 9533

Grow your practice:

- Free for accountants and bookkeepers in practice.

- Pay a discounted rate for every client you add.

- Log in to see the latest pricing offers.

- Automatic enrolment as a silver ProAdvisor.

Get the support:

- VAT bridging software and e-Filing.

- Expert phone support.

8am-8pm Mon-Fri [ex. bank holidays]

- Free QuickBooks Online and Advanced Certification training.

- Free onboarding, marketing and Making Tax Digital resources.

- Talk to us about licence package options and payroll discounts on 0808 168 9533.

Frequently asked questions

MTD resources for accountants and bookkeepers

How can we help?

Talk to sales: 0808 168 9533

9.00am - 5.30pm Monday - Thursday

9.00am - 4.30pm Friday