- Software with you in mind

- QuickBooks for accountantsSupporting you and your clients

- Pricing for accountantsWhatever your practice needs, there's a plan for you

- Client onboardingWe'll get them up and running

- MailchimpThe perfect partners for your practice

- Be found by new clientsIn our Find-a-ProAdvisor directory

- Referral programmeBoth get £100 in Amazon vouchers

Become a ProAdvisorJoin our free ProAdvisor Programme and access tools, resources and exclusive discounts to help take your practice to the next level. - online Accounting for sole traders

- QuickBooks for sole tradersEverything you need to know

- Pricing for sole tradersWhatever your business needs, there's a plan for you

- Onboarding as a sole traderSet yourself up for success

- Switch to QuickBooksMove to us from another solution

- Find an accountantSupport from a QuickBooks certified accountant near you

- IndustriesOur accounting software is designed for every industry. Find yours here

- Discover QuickBooksSee why over 6.5 million subscribers worldwide choose us

- QuickBooks Self-employedSoftware for sole traders not registered for VAT

- QuickBooks OnlineOur range of simple, smart accounting software solutions

- Connect appsSeamlessly connect 300+ apps to QuickBooks

features for sole traders - Grow your business

- QuickBooks for limited companiesEverything you need to know

- Pricing for limited companiesWhatever your business needs, there's a plan for you

- Onboarding as a limited companySet yourself up for success

- Switch to QuickBooksMove to us from another solution

- Find an accountantSupport from a QuickBooks certified accountant near you

- IndustriesOur accounting software is designed for every industry. Find yours here

- StartupsGrow your business from day one with QuickBooks

- Discover QuickBooksSee why over 6.5 million subscribers worldwide choose us

- QuickBooks OnlineOur range of simple, smart accounting software solutions

- QuickBooks AdvancedDiscover our most powerful plan yet, made for growing businesses

- Connect appsSeamlessly connect 300+ apps to QuickBooks

- Plans & Pricing

- Talk to us: 0808 168 9533

- How can we help you today

- QuickBooks support hubWe're here to support you through every step

- Getting startedEverything you need to get set up for success

- Desktop to OnlineHow to switch from QuickBooks Desktop to QuickBooks Online

- Discover QuickBooksSee why over 6.5 million subscribers worldwide choose us

- Switch to QuickBooksMove to us from another solution

- QuickBooks OnlineOur range of simple, smart accounting software solutions

Invoices & expensesBanking & Payments - Sign in

Getting Started | Payroll Software

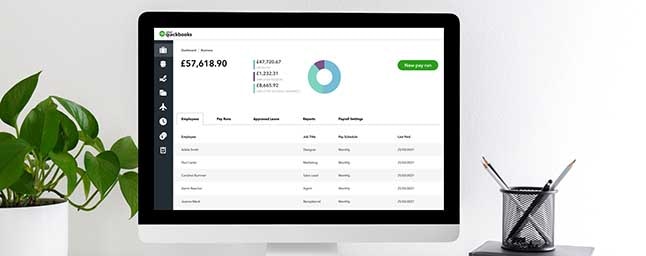

Get started with QuickBooks Payroll

These easy guides will show you how to set up QuickBooks Core Payroll and Advanced and run your payroll. Our guides are all you need to start getting the most of off QuickBooks Payroll Core and Advanced

Switching from another payroll provider

Import employees from HMRC Basic Tools

If you have been using HMRC Basic Tools to run your payroll, you can now import your employees into QuickBooks Online Payroll.

Import data from any payroll provider

Use our data importer tool with QuickBooks Desktop Payroll or any software which lets you export, download or copy/ create .xml files.

Getting started from scratch

Add employer details

Be confident about running payroll and paying your employees without a hitch. Everything’s easier when you get set up correctly, starting with employer details.

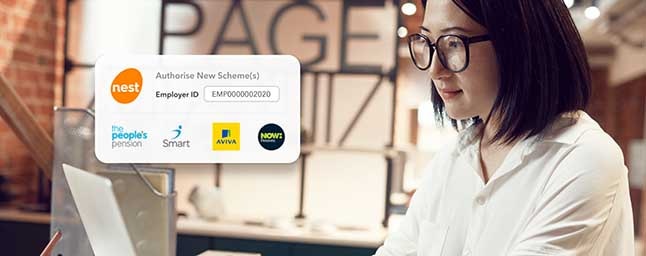

Set up workplace pension

Do you need to have a pension set up for your employees? Follow our 8-step guide to auto-enrolment.

Set up to claim Employment Allowance

If you qualify for Employment Allowance you could reduce your Employer Class 1 National Insurance Contributions by £4,000 this tax year. Learn how to get set up.

Stay compliant with HMRC

You need to submit a Full Payment Submission (FPS) to HMRC on or on or before payday.

Add employees

Our step-by-step guide will help you set up your employees.

Set up pay schedules

Learn how to set the date and frequency of your pay run.

Multiple pay schedules

Paying some employees weekly and others monthly? Set up a pay schedule that suits your needs.

Add and customise employee deductions

How to manage Tax, National Insurance Contributions and student loans as well as after-tax deductions, including union fees.

Running payroll

If you haven’t received an employer PAYE reference number, you can still run your payroll and pay your employees. However, as soon as you receive the PAYE reference you must submit your payroll to HMRC, giving code G as the late reporting reason. See HMRC guidance for more information.

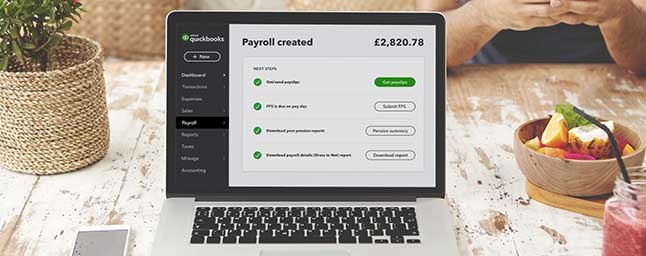

Run payroll

Now you’re all set up, it’s time to run your payroll. Our guide shows you how.

Construction Industry Scheme deductions (CIS)

Automatically pull your deductions suffered under the Construction Industry Scheme (CIS) from your books. Learn how to record your deductions and submit to HMRC.

Issue payslips through the portal

The best way to share payslips with your employees is through QuickBooks Workforce, our self-service employee portal.

Email or download payslips

You also have the option of emailing or downloading payslips to share with your employees.

Submit information to HMRC

Make sure you send HMRC your Full Payment Submission (FPS) on or before payday. If you’ve set up automatic reporting a tick will show that it’s been submitted.

Employer Payment Summary (EPS)

Needed in some cases, these aren’t automatically submitted by QuickBooks and are due by 19th of the following month, so a payment made in March would need to be recorded by 19 April.

Pension contributions

If you are making pension contributions you need to send a report to your pension provider. This can be sent automatically to Nest.

Pension providers

For other pension providers, follow these steps.

Delete a pay run

We all make mistakes. If you need to delete your payroll run and start again, here’s how.

Switching from another payroll provider

Setting up HMRC settings

How to prepare to submit Real Time Information (RTI) to HMRC.

Getting started from scratch

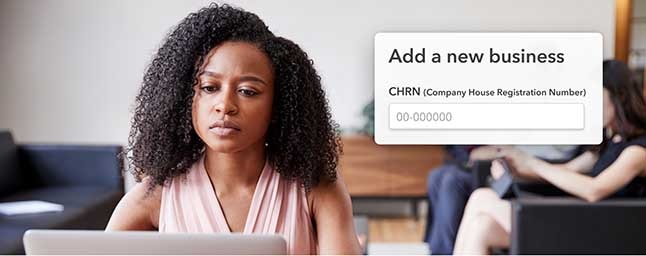

Set up company details

Enter your company details

Add and manage users

Add new users, manage permissions and edit existing user permissions.

Creating payslips

Learn how to create and customise payslips.

Add employees manually

Add employees by importing data from Excel

Add employees through self set up

Set up and customise BACS settings

Learn how to set up your payment file settings.

Set up your pensions automatically

Connect to PensionSync to submit your pensions automatically.

Set up your pensions manually

If your pension scheme is not supported automatically use the manual set up.

Running payroll

If you haven’t received an employer PAYE reference number, you can still run your payroll and pay your employees. However, as soon as you receive the PAYE reference you must submit your payroll to HMRC, giving code G as the late reporting reason. See HMRC guidance for more information.

Create a new pay run

Once you’ve added your employees and completed your settings in Advanced Payroll you’re ready to process a new pay run.

Finalise a pay run

When a pay run is finalised the data is made available in reports and payslips can be seen on the employee portal.

Delete a pay run

We all make mistakes. If you need to delete your payroll run and start again, here’s how.

Automate your pay run

Save time on salaried employees and directors pay by setting up an automated process.

Annual leave

Learn how to record annual leave through the leave requests tab.

Issue payslips through the portal

The best way to share payslips with your employees is through the WorkZone self-service employee portal, available on the web or an app.

Email or download payslips

You also have the option of emailing or downloading them.

Submit information to HMRC

Make sure you send HMRC your Full Payment Submission (FPS) on or before payday. If you’ve set up automatic reporting a tick will show that it’s been submitted.

Need an Employer Payment Summary?

These are only needed in some cases (for example if Statutory payments are made). They aren’t automatically submitted by QuickBooks and are due by 19th of the following month.

Expenses and timesheets

Set up timesheets

Have employees who need to track their hours in timesheets? Enable timesheets and manage which work types are available to which employees.

Manage expenses

Add, delete and define the employee expense categories used by your business.

How can we help?

Talk to sales: 0808 168 9533

9.00am - 5.30pm Monday - Thursday

9.00am - 4.30pm Friday