- Software with you in mind

- QuickBooks for accountantsSupporting you and your clients

- Pricing for accountantsWhatever your practice needs, there's a plan for you

- Client onboardingWe'll get them up and running

- MailchimpThe perfect partners for your practice

- Be found by new clientsIn our Find-a-ProAdvisor directory

- Referral programmeBoth get £100 in Amazon vouchers

Become a ProAdvisorJoin our free ProAdvisor Programme and access tools, resources and exclusive discounts to help take your practice to the next level. - online Accounting for sole traders

- QuickBooks for sole tradersEverything you need to know

- Pricing for sole tradersWhatever your business needs, there's a plan for you

- Onboarding as a sole traderSet yourself up for success

- Switch to QuickBooksMove to us from another solution

- Find an accountantSupport from a QuickBooks certified accountant near you

- IndustriesOur accounting software is designed for every industry. Find yours here

- Discover QuickBooksSee why over 6.5 million subscribers worldwide choose us

- QuickBooks Self-employedSoftware for sole traders not registered for VAT

- QuickBooks OnlineOur range of simple, smart accounting software solutions

- Connect appsSeamlessly connect 300+ apps to QuickBooks

features for sole traders - Grow your business

- QuickBooks for limited companiesEverything you need to know

- Pricing for limited companiesWhatever your business needs, there's a plan for you

- Onboarding as a limited companySet yourself up for success

- Switch to QuickBooksMove to us from another solution

- Find an accountantSupport from a QuickBooks certified accountant near you

- IndustriesOur accounting software is designed for every industry. Find yours here

- StartupsGrow your business from day one with QuickBooks

- Discover QuickBooksSee why over 6.5 million subscribers worldwide choose us

- QuickBooks OnlineOur range of simple, smart accounting software solutions

- QuickBooks AdvancedDiscover our most powerful plan yet, made for growing businesses

- Connect appsSeamlessly connect 300+ apps to QuickBooks

- Plans & Pricing

- Talk to us: 0808 168 9533

- How can we help you today

- QuickBooks support hubWe're here to support you through every step

- Getting startedEverything you need to get set up for success

- Desktop to OnlineHow to switch from QuickBooks Desktop to QuickBooks Online

- Discover QuickBooksSee why over 6.5 million subscribers worldwide choose us

- Switch to QuickBooksMove to us from another solution

- QuickBooks OnlineOur range of simple, smart accounting software solutions

Invoices & expensesBanking & Payments - Sign in

File your VAT return online with smart VAT software

Online VAT management made easy

Submit your VAT returns online with QuickBooks accounting software and stay compliant with HMRC’s Making Tax Digital rules. You can prepare, track and file VAT returns - all in one place. Plus, our error-checking technology checks your VAT for common mistakes.

Making Tax Digital ready

HMRC recognised

Value-added software

QuickBooks accounting software calculates the amount of VAT you owe and reminds you when it’s due. Our smart error-checking technology checks for common mistakes and lets you make an online submission directly to HMRC.

Made for Making Tax Digital

QuickBooks is recognised by HMRC and designed in line with MTD regulations. You can run our error checker to surface common mistakes and make an online submission directly to HMRC. QuickBooks supports standard, cash and flat-rate schemes.

"A well-designed, robust application. With functionality that criss-crosses accounting and non-accounting domains, this is definitely a winner and a keeper."

App Store review

No more data entry

Swap manual data entry for automatic calculations and accurate record keeping. Snap & store receipts, auto-track mileage and easily categorise transactions - all in one place.

"Unbelievably simple. I have never submitted any Making Tax Digital for VAT return ever before but I honestly couldn’t believe how easy it was. Few mouse clicks and it was all over. Shouldn’t have worried!"

Nick, AutoAudio

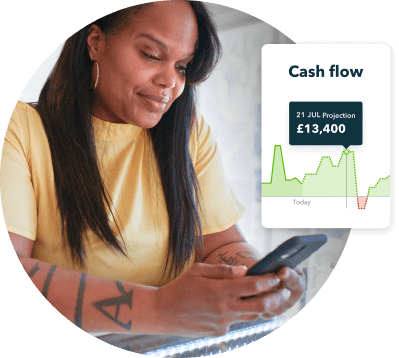

Always know how much you owe

Take control of your cash flow and make smarter business decisions. Log in to your account anytime, anywhere using your smartphone, tablet or computer. See exactly what’s due with our real-time dashboard and calculate your VAT-related expenses.

"So simple to use makes my life a lot easier as everything can be done literally within minutes."

App Store review

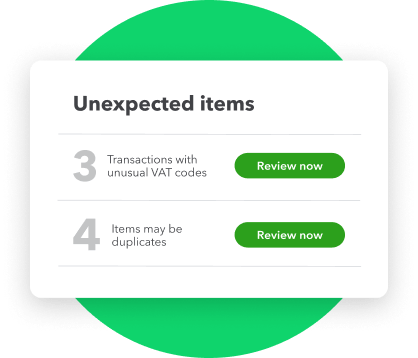

Automatically check your VAT for errors

Our helpful error-checking technology spots common errors, duplicates and anomalies in your VAT. Be more confident when you submit your VAT to HMRC through QuickBooks.

"It’s a great way of summarising everything that goes into the return without having to review everything for the quarter."

Tom Ridgway, Wyvern 3D Ltd

Spend more time developing your small business

Detailed VAT reports

Get an in-depth picture of what you've paid and what you owe.

Personal notifications

Never miss another VAT deadline. You'll get a reminder when your return is due.

MTD compliant

Your records will be fully compliant with HMRC's Making Tax Digital rules for VAT.

Frequently asked questions

QuickBooks Making Tax Digital for VAT software is available to all QuickBooks Simple Start, Essential, Plus and Advanced subscribers. Use of QuickBooks MTD for VAT software and bridging software must be aligned with HMRC's eligibility requirements and includes additional setup between the small business and HMRC.

QuickBooks MTD software currently supports Standard, Cash and Flat Rate schemes. QuickBooks Bridging Software supports Standard and Cash schemes. Businesses whose home currency is not GBP are currently not supported.

Receive a 75% discount on the current monthly price for QuickBooks Online Simple Start or 75% discount on the current monthly price for QuickBooks Online Essentials or 75% discount on the current monthly price for QuickBooks Online Plus or 50% discount on the current monthly price for QuickBooks Online Advanced for the first 6 months of service, starting from date of enrolment, followed by the then-current monthly price. Your account will automatically be charged on a monthly basis until you cancel. You must select the Buy Now option and you will not be eligible for a 30-day free trial. Offer valid for new QuickBooks Online customers only. No limit on the number of subscriptions ordered. You can cancel at any time by calling 0808 168 9533. Discount cannot be combined with any other QuickBooks Online offers. Terms, conditions, features, pricing, service and support are subject to change without notice. All prices shown exclude VAT.

Enjoy 75% off for 12 months on the current fees when you pay for your QuickBooks Online subscription on an annual, upfront basis. If you cancel your QuickBooks Online subscription within the pre-paid 12-month period, you will not be eligible for a refund, but will retain full access to your QuickBooks Online subscription for the remainder of the 12-month period. Alternatively if you wish to receive a refund then you need to cancel by calling us on 0808 234 5337 within the pre-paid 12 month period and we will provide a pro-rata refund and deactivate your account. Unless cancelled by you prior, your annual subscription will auto-renew on the 12 month anniversary of your sign-up date using the billing details you have given us. Discounts, prices, terms and conditions are subject to change.

Receive 100% off the current monthly subscription price for QuickBooks Core or QuickBooks Advanced Payroll for the first 3 months of service, starting from the date you subscribe to the service, followed by the then-current monthly price. Your account will automatically be charged on a monthly basis for the subscription fee and for all pay runs processed in the previous month, until you cancel. You must select the Buy Now option, and you will not be eligible for a 30-day free trial. Offer valid for new QuickBooks Online customers only. No limit on the number of subscriptions ordered. You can cancel at any time by calling 0808 168 9533. Discount cannot be combined with any other QuickBooks Online offers. Terms, conditions, features, pricing, service and support are subject to change without notice. All prices shown exclude VAT.

Discount valid until the 19 February 2024.

Receive 50% off the current monthly subscription price for QuickBooks Advanced for the first 6 months of service, starting from the date of enrolment, followed by the then monthly price. Your account will automatically be charged on a monthly basis for the subscription fee and for all pay runs processed in the previous month, until you cancel. You must select the Buy Now option and will not receive a one month trial. Offer valid for new QuickBooks Online customers only. No limit on the number of subscriptions ordered. You can cancel at any time by calling 0808 239 9692. Discount cannot be combined with any other QuickBooks Online offers. Terms, conditions, features, pricing, service and support are subject to change without notice. All prices shown exclude VAT.

QuickBooks Advanced Payroll allows you to automatically submit information to the following pension providers: NEST, The Peoples Pension, Smart Pensions, Aviva and NOW:Pensions

Free onboarding sessions are offered to all newly subscribed customers and trialists, excluding customers on our QuickBooks Self-Employed product. We offer 1 session per customer and reserve the right to remove this offering at anytime. Invitations are sent via email and in-product messaging once signup has been completed. A link will be included in the message for you to book a session using our calendar tool.

Mileage tracking is available on QuickBooks Self-Employed and QuickBooks Online on iOS and Android only.

These terms apply to QuickBooks UK customers only. Bulk-pricing discount offer is valid only if you are signing up for more than one QuickBooks Online subscription with each order. View terms and conditions for multiple accounts pricing here. To inquire further about the bulk-pricing discount offer, please call 0808 168 9533

QuickBooks UK support hours:

- QuickBooks Online Phone – Monday to Friday 8am to 7pm.

- QuickBooks Online Live Messaging – Monday to Friday 8am to 12am, Saturday and Sunday 8am to 6pm.

- QuickBooks Self-Employed Live Messaging – Monday to Friday 8am to 12am, Saturday and Sunday 8am to 6pm.

'Save around 8 hours a month' based on respondents new to QuickBooks; Intuit survey June 2016.

How can we help?

Talk to sales: 0808 168 9533

9.00am - 5.30pm Monday - Thursday

9.00am - 4.30pm Friday