What is virtual bookkeeping?

By Cathie Ericson December 20, 2023

Most entrepreneurs start a business to be their own boss and do what they love. Running a company, though, isn’t all about visionary leadership and big ideas. Being a small business owner includes plenty of drudgery, especially when it comes to keeping track of the books. That’s where virtual bookkeeping comes in.

Virtual bookkeeping at a glance

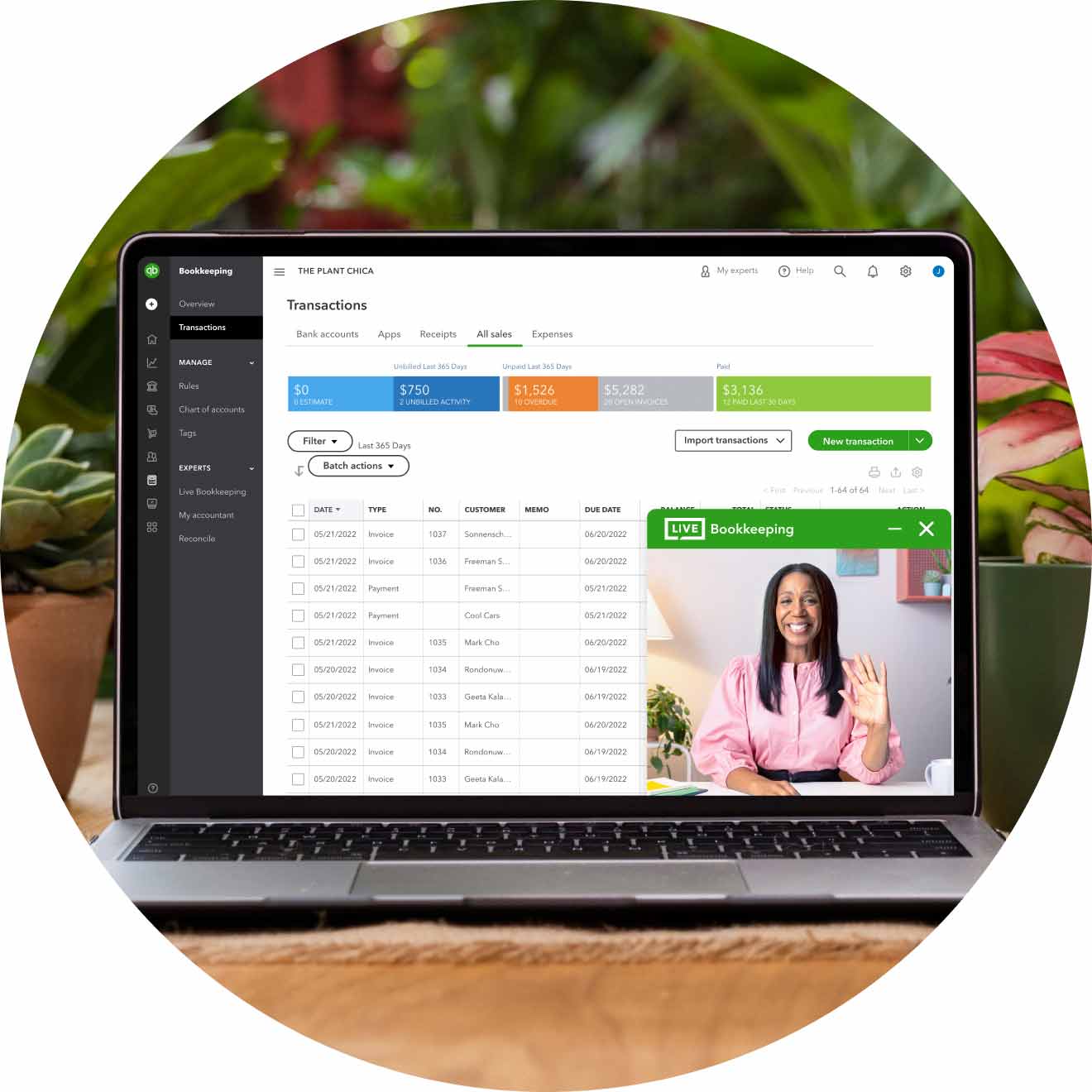

Virtual bookkeeping, also known as remote bookkeeping, connects small business owners with online bookkeepers who can help keep a business profitable by tracking money in and money out. Using cloud-based accounting solutions and modern collaboration tools like video conferencing, screen share, and chat, virtual bookkeepers can talk business owners through questions and challenges related to their books and keep their records current.

Virtual bookkeepers offer the peace of mind that comes with knowing your books and finances are up to date and organized—without the pressure of hiring an in-house professional. Virtual bookkeeping services are especially attractive to small business owners who need help managing their books but aren’t sure where to start.

Features of virtual bookkeeping:

- Video conferencing, screen share, and chat for coaching and collaboration

- Document sharing of receipts, bank statements, and more

- Custom reports for an overview of your business’ financial health

Is a virtual bookkeeper right for you? Here are three reasons small businesses choose virtual bookkeeping

1. Virtual bookkeeping can keep you ready for tax time

Tax laws are becoming more complex, so small business owners turn to accounting professionals to learn about tax-deductible expenses. From a day-to-day business perspective, virtual bookkeepers can ensure your records are up to date and organized for tax time. This way, you can focus your energy on launching new products and spending time with family and friends—not stressing the IRS.

2. Virtual bookkeeping is trustworthy

Turning over your finances to an accountant or bookkeeper can feel risky at best and downright scary at worst. Your business is your livelihood, after all. You want to be sure you are working with someone ethical, honest, and dependable, which is why vetting and certification are key. The best virtual bookkeeping services will vet, certify, and train their bookkeepers for you, as Intuit does with all QuickBooks Live Bookkeepers, and ensure they have experience in various industries.

3. Connect with bookkeepers wherever work takes you

These days, we live in an on-demand economy and thrive on being connected on the go. Why should bookkeeping be any different? Connecting with a bookkeeper from wherever your work takes you means you get answers when you need them most. Like an in-house bookkeeper, virtual bookkeepers get to know you and the needs of your industry and business. With the right virtual bookkeeping service, you gain a better understanding of your business performance.

QuickBooks Live Bookkeeping meets your needs

The good news? Access to QuickBooks Live Assisted Bookkeeping is already built into QuickBooks Online to give you affordable ongoing access to live experts. Here are the benefits the remote bookkeeping service offers:

Updated books

A virtual bookkeeper can give you guidance and answer questions about categorizing transactions, reconciling credits and debits, and managing your workflow.

Business reporting

Your business can run more smoothly when you review your income statement, balance sheet, and cash flow statement with a bookkeeper.

On-demand assistance

Have a question that keeps coming up and don’t know where to turn? You can connect with a bookkeeper via message or video chat for personalized help at any time of year.

Convenience

Skip the drive through traffic and the awkward silence of an in-person bookkeeper's waiting room. Get down to business sooner with online bookkeeping.

Time back in your day

Get expert help for at least one item on your to-do list. Check off a task that can be time-consuming with our live experts, so you can get back to your business.

Confidence in your books

Your books are too vital to the health of your business to risk errors. With a professional helping, you’ll gain peace of mind.

Get bookkeeping help for your small business

Virtual bookkeeping services through QuickBooks Live Assisted Bookkeeping can help your business stay organized for success.

QuickBooks Live Bookkeeping requires QuickBooks Online subscription. Additional terms, conditions, limitations, and fees apply.

5 ways bookkeeping can save your business—and how to get started

By John Shieldsmith August 13, 2019

Bookkeeping isn’t just for tax season. If done right, bookkeeping can be a great way for business owners to maximize how far their money goes and plan for the future. When your finances are in order, it’s easier to tell how your business is performing overall and where you can improve.

Still not sold on the benefits of bookkeeping? Here are five ways bookkeeping can help your business. And as a bonus: three ways to start bookkeeping for your business.

1. Bookkeeping improves cash flow

Bookkeeping goes well beyond organizing your bank and other financial statements in the right folders. With solid bookkeeping practices, you have a better idea of which invoices clients need to pay and which vendors you need to pay. When you have a better idea of when money is coming and going, you can get ahead of potential cash flow issues. And you’ll spend less time sifting through messy finances.

2. Bookkeeping ensures tax savings and audit preparation

Proper bookkeeping makes tax preparation much easier, especially when you have separate accounts for business and personal use. The right bookkeeping procedures can prevent missed payments and provide better records to improve your tax return. The IRS requires business records to be available at all times for their inspection, and if they do examine your tax returns, clean books ensure you can explain everything you reported.

3. Bookkeeping helps you gain capital and investors

Clear and concise bookkeeping makes your company’s financial standing easier to show, which will be a big help if you’re looking for capital or investors. Accurate historical financial data will help banks >project the profitability of your business, and clean books can prove there aren’t financial or legal liabilities or associated with investing in your business. Few banks and investors will be willing to invest in a company that has messy finances.

4. Bookkeeping improves business decisions

When you have a clear understanding of your budget, cash flow, and expenses, you’re more equipped to make better business decisions. For example, if you can review your up-to-date income and expenses data on a regular basis, you’re more likely to recognize discrepancies between your business’s actual and projected performance early on, so you can dig deeper into the root of the change and make adjustments where necessary.

Bonus: 3 ways to start bookkeeping for your business

Now that you know why bookkeeping is so important, the next step is to start bookkeeping for your business. Here are some ideas to get you the help you need to set up your bookkeeping system.

1. Take a DIY approach

Starting anything new is hard—just think about how hard it was to start a business! Fear may be why you haven’t started bookkeeping yet, but it’s worth the effort. You may not be ready to do all the books yourself, but empower yourself to learn the basics, like data entry. At the end of the day, you’ll have a better understanding of what goes into bookkeeping and how the financial planning process works

2. Hire an in-house bookkeeper

Hiring an in-house bookkeeper means you have a dedicated expert in your office, available when you need them. Whether your bookkeeper fills a full- or part-time position, just having an expert on hand can do wonders for your finances.

3. Work with a virtual bookkeeper

A virtual bookkeeper, or remote bookkeeper, is a great way to get professional help with your books without leaving your home or office. When you need help, you can speak to your bookkeeper over the phone or one-way video chat. Virtual bookkeeping services are great for business owners in remote or rural areas, and for those who don’t have the time or resources to vet, train, and hire a new team member on their own.

Can I hire a bookkeeper instead of an accountant?

By Ken Boyd September 6, 2019

In some cases, business owners can hire a bookkeeper instead of an accountant. But the type of professional you hire depends on your business needs. Financial responsibilities vary based on the size of your business, the number of workers you employ, and more. To get a better idea of what your business might require, let’s explore the differences between bookkeepers and accountants.

What is a bookkeeper?

Bookkeepers maintain a business’s books—or records of all business transactions. A good bookkeeper may have a degree in business or accounting, and many have years of experience and work and certifications in accounting solutions like QuickBooks without a degree. A typical bookkeeper’s job duties include entering and tracking financial data. Other services might include:

- Reviewing financial transactions and posting entries into your accounting software.

- Reconciling bank accounts and ensuring financial information posts to the correct account.

- Data entry for payroll processing. That includes maintaining or making changes to employee tax withholdings and wage rates.

- Monitoring accounts payable to ensure the business pays vendors on time. Bookkeepers may also update you on accounts receivable to improve cash flow.

Managing a small business is challenging. But a full-time bookkeeper can free up your time and add tremendous value. If you’re handling the accounting tasks on your own, consider starting with a part-time bookkeeper.

What is an accountant?

An accountant may perform all the same tasks as a bookkeeper plus additional advisory responsibilities. In addition to data entry and reconciliation, an accountant provides key financial statements to business owners and stakeholders. Those include profit-and-loss statements, balance sheets, and anything else a business owner might need to do their taxes.

Accountants practice accountancy. So they’re likely to have received a formal education or be a Certified Public Accountant (CPA). CPAs have accounting degrees and must pass the Uniform Certified Public Accountant Examination. The CPA credential is valued highly in the accounting profession.

Accountants may supervise bookkeepers in their firms, review accounting transactions, and manage the recordkeeping process. Their work also includes:

- Gathering financial statements. They make adjustments to the trial balance and generate income statements, balance sheets, and cash flow statements.

- Preparing the financial reports required to generate tax returns. An accountant may file taxes with the IRS or work with an accounting firm that provides tax services

- Data entry for payroll processing. That includes maintaining or making changes to employee tax withholdings and wage rates.

- Monitoring accounts payable to ensure the business pays vendors on time. Bookkeepers may also update you on accounts receivable to improve cash flow.

Managing a small business is challenging. But a full-time bookkeeper can free up your time and add tremendous value. If you’re handling the accounting tasks on your own, consider starting with a part-time bookkeeper.

Thank you

A QuickBooks expert will be in touch with you shortly.