How

Let a bookkeeper take bookkeeping tasks off your plate, so you can focus on what matters to you.

Start with a clean slate

First, a bookkeeper goes through your past books line by line and brings them up-to-date. This includes a detailed review of your chart of accounts to ensure all of your past transactions are organized correctly.

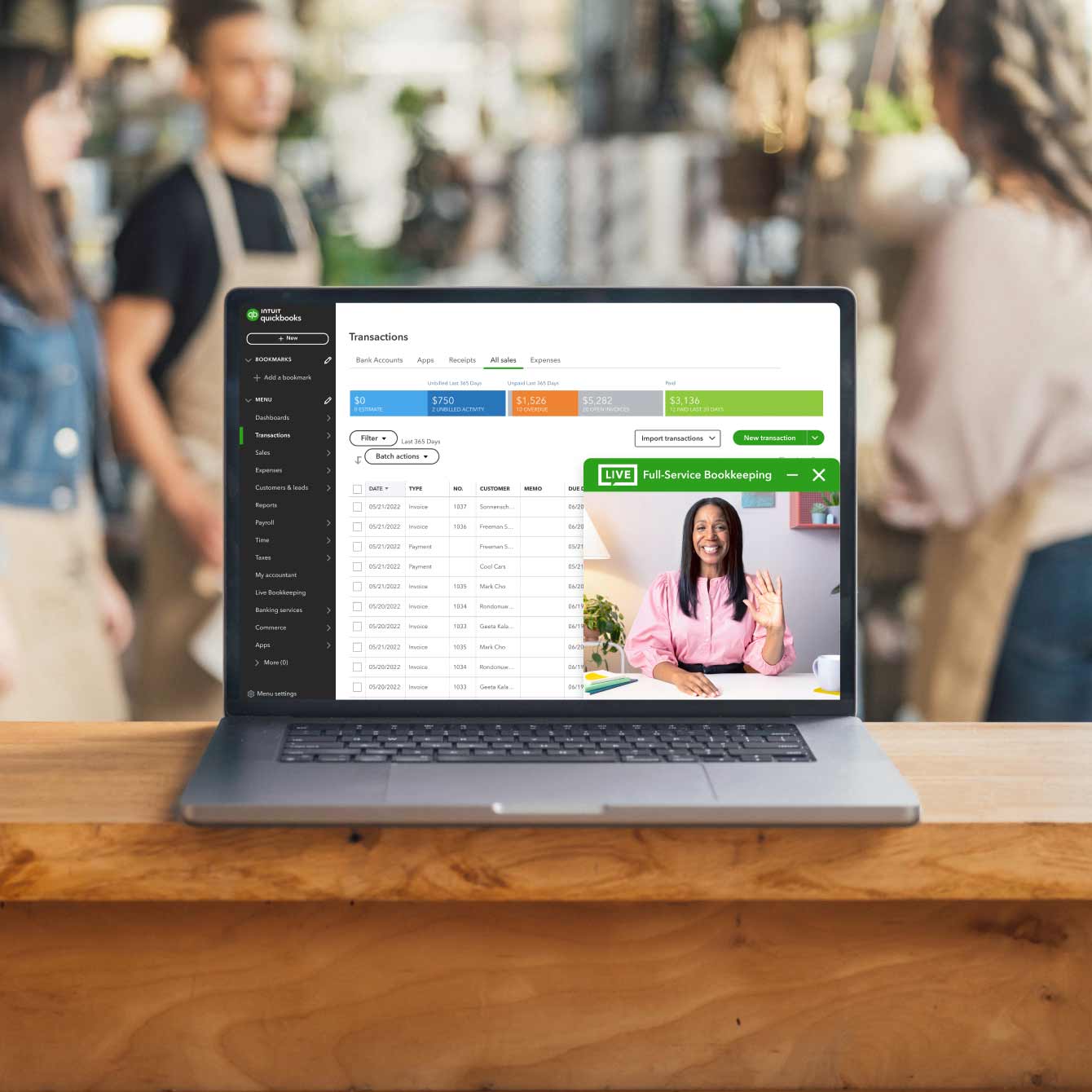

Collaborate virtually

Next, we pair you with your ongoing bookkeeper to manage your bookkeeping.1

Easily track their progress in real time, schedule a video call, or send your general bookkeeping questions to our team of bookkeeping experts.

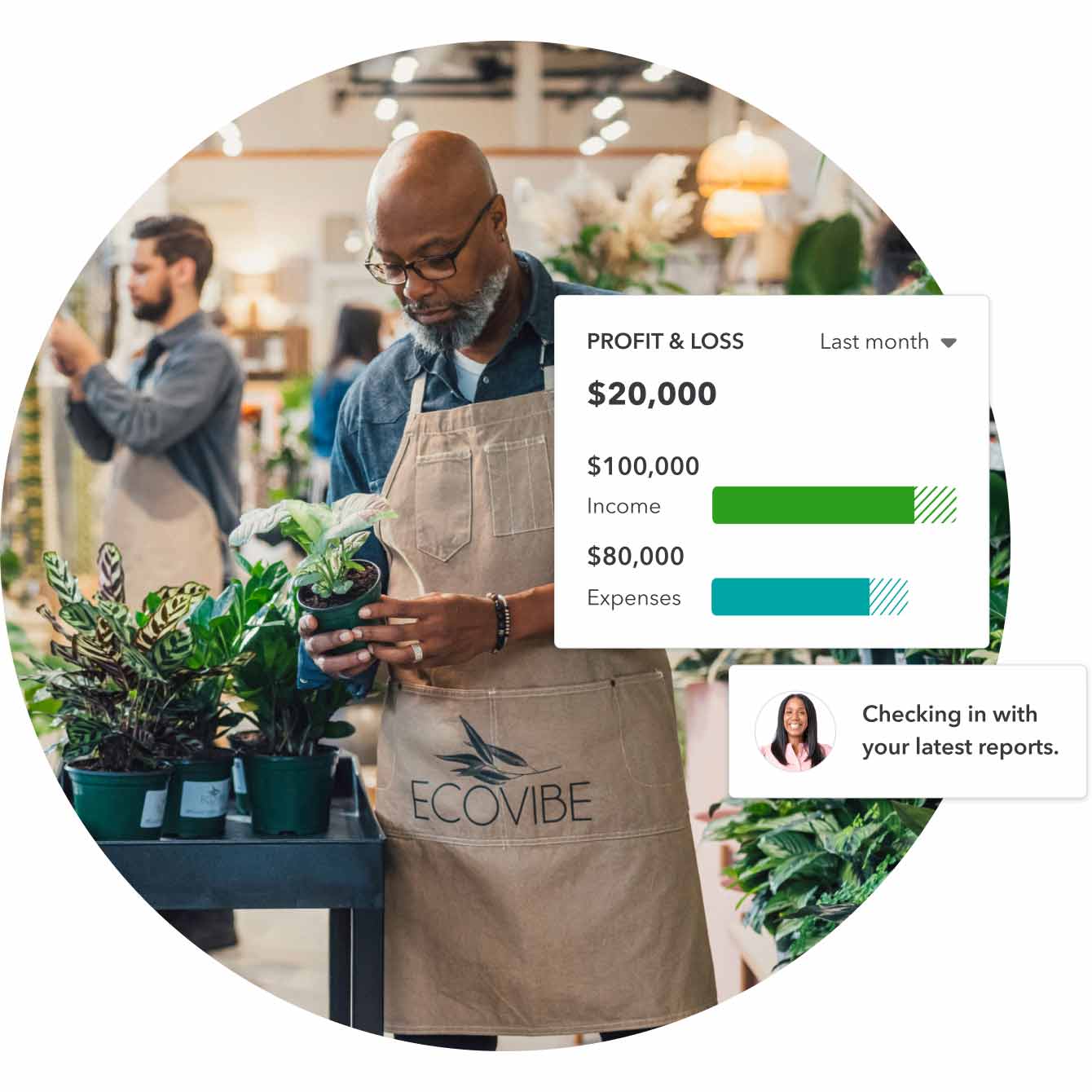

Know where you stand

Your bookkeeper can run detailed reports giving you a clear view of your business performance.

With clean books and accurate reports, you can make more informed business decisions, face tax time with confidence, and have more time to focus on your business.**

Thank you

A QuickBooks expert will be in touch with you shortly.

Thousands of businesses use QuickBooks Live Bookkeeping2

"QuickBooks Live Bookkeeping has allowed me to focus more on tasks I enjoy like making new products, tweaking labels, and calling customers."

Al & Deb Wood,

Wood’s Vermont Syrup Co.

"It’s worth every penny to have somebody straighten out my books and maintain it year after year. The books are not what I want to do. My specialty is building this business."

Lionel Martinez,

Home Services by Lionel

Frequently asked questions

Full-Service Bookkeeping includes two phases: cleanup and ongoing bookkeeping

- In the cleanup/setup phase, your bookkeeper helps you set up your chart of accounts, connects your banks, and teaches you the basics of QuickBooks. If you have information in QuickBooks already, your bookkeeper will help clean it up in the first month of service.

- As part of ongoing bookkeeping, your bookkeeper categorizes your transactions and reconciles your accounts each month.

- Your bookkeeper can close your books and prepare a trial balance. They can also send PDF copies of key financial reports including your profit and loss statement and balance sheet.

Full-Service Bookkeeping doesn’t include sending invoices, paying bills, or management of inventory, accounts receivable, or accounts payable. The service doesn’t include financial advisory services, tax advice, facilitating the filing of income or sales tax returns, creating or sending 1099s, or management of payroll. QuickBooks Online offers Full Service Payroll for an additional cost.

The team of QuickBooks Live Bookkeepers includes professionals from almost all industries. During the onboarding process, we try to match you with a primary bookkeeper who has experience in your industry. If that isn’t possible, we try to make sure that a member of the bookkeeping team has the experience necessary to handle industry-specific questions that you may have.

There’s no set amount of time you get per month. Small businesses often schedule video appointments once or twice per month to discuss questions and to review results. You’re limited to one scheduled appointment at a time and appointments have to work within your bookkeeper’s schedule. Communications that are available any time include document sharing and live chat with a member of your bookkeeper’s extended team.

QuickBooks Live Bookkeepers schedule their availability for a set number of hours per week between 6:00 AM (PT) and 6:00 PM (PT) Mon–Fri. For example, one bookkeeper may be available 8 hours per day, 3 days a week, while another may be available 5 hours per day, 5 days a week. During the onboarding process, we’ll work to match you with a bookkeeper whose availability best matches yours.

To support your bookkeeper’s work, you’ll be responsible for managing your business and providing information to your bookkeeper when they need it. Managing your business includes sending invoices, paying bills, and management of inventory, accounts receivable, and accounts payable. Examples of information you’re responsible for providing include account information to connect bank accounts to QuickBooks Online, information about any unlinked banked accounts that need to be managed, transaction detail when requested, financial records (i.e. account statements), and descriptions of any established capitalization or accounting policies for the business.

Monday - Friday, 5 AM to 6 PM PT

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

Guarantees

Accurate Books Guarantee: Accurate Books Guarantee is only available for active customers of QuickBooks Live Monthly Bookkeeping who have provided their current business tax return. If your Live Bookkeeper makes an error that requires you to re-open your books for any month, we’ll correct the error in your books for the month that the error occurred at no additional charge.

Eligible errors include only those made by a Live Bookkeeper. An “error” is: a) a transaction that has been incorrectly categorized to the wrong account; b) an account balance in QuickBooks that doesn’t match the actual account balance; or c) improper transactions which can’t be supported by documentation (including client responses and client meeting notes).

If you invoke the guarantee, QuickBooks will conduct a full n evaluation of the Live Bookkeeper’s work. You’ll need to provide QuickBooks with a receipt for the transaction in question, correspondence from your outside tax accountant, or a document stating the balance of the account if an account balance is in question.

Live Bookkeepers aren’t responsible for errors resulting from incorrect information that you provide, or if you re-open the books by overriding closure after a Live Bookkeeper completes the month-end closure.

**Product information

QuickBooks Live Monthly Bookkeeping pricing tiers: Live Bookkeeping is available to QuickBooks Online subscribers and is sold separately. QuickBooks Live Cleanup is required for Live Monthly Bookkeeping. Cleanup fee is customized based on signup month, tax filing status, and business start date. Following a 30 day period after signup, the ongoing Live Bookkeeping service is available in 3 different pricing tiers, depending on your company’s average monthly expenses over a period of 3 consecutive months. After the first month, you’ll be charged monthly at the then-current monthly fee based on your average monthly expenses over the previous 3 months, unless you cancel. Your business’s average monthly expenses and associated subscription pricing may be reassessed at Intuit’s sole discretion. Currently:

- If your monthly average is $0-10,000 per month, the monthly price for QuickBooks Live is $200.

- If your monthly average is $10,001-50,000, the monthly price for QuickBooks Live is $300.

- If your monthly average is $50,001 or more, the monthly price for QuickBooks Live is $400.

QuickBooks Live Monthly Bookkeeping services: After signup, a Live Bookkeeper provides cleanup services that start from the date of your last business tax return or business incorporation date (if more recent) through the end of the calendar month before first sign-up to Live Bookkeeping. The services provided during the first month are as follows, as applicable: update bookkeeping based on information you provide; connect bank and credit cards; categorize and update transactions up until the last tax-filing date; reconcile bank and credit card accounts with past statements, as provided by you; reconcile remaining balance sheet accounts; and run a summary report of work completed, balance sheet, and profit loss statement of YTD for cleanup period(s).

A Live Bookkeeper cannot begin cleaning up your past books until they receive the required supporting documentation, which your bookkeeper will request from you after your first meeting. Once your bookkeeper receives all the necessary documentation, they’ll typically complete your cleanup within 30 days. In some cases, your cleanup may take longer depending on timeliness of documentation and the complexity of your books.

During each subsequent month, ongoing Live Bookkeeping services include: an overview of the main features of QBO; setup of customers and vendors; assistance with reports and reporting tools; setup of chart of accounts; assistance with bank connections, expense type classification, categorization, and reconciliation based on information you provide; importing of historical data; and ongoing assistance with bookkeeping practices). Some basic bookkeeping services may not be included and will be determined by your Live Bookkeeper. The Live Bookkeeper will provide help based on the information you provide. For more information about services provided by Live Bookkeeping, refer to the QuickBooks Terms of Service.

QuickBooks Live Bookkeeping Cleanup: The QuickBooks Live Bookkeeping Cleanup only applies to bookkeeping records up to your last tax filing. You must have filed your business’ prior tax return and provide a copy of the return before cleanup services can begin. A Live Bookkeeper cannot begin cleaning up your past books until they receive all of the required supporting documentation, which your bookkeeper will request from you after your first meeting. Once your bookkeeper receives all the necessary documentation, they’ll typically complete your cleanup within 30 days. In some cases, your cleanup may take longer depending on timeliness of documentation and the complexity of your books.

Tax-ready books: Live Bookkeeping doesn’t include tax preparation services or assistance with tax preparation, or assurance services. Consult a tax preparer for tax advice related to the preparation of your tax return. The Live Bookkeeping Cleanup service is from the date of your last business tax return through the end of the calendar month before first sign-up to Live Bookkeeping.

#Claims

1. Time savings: Based on a survey of QuickBooks Live Bookkeeping customers, as of November 2021.

2. Bookkeeper experience: Based on internal data, as of November 2021.

3. Tax time: Based on a survey of QuickBooks Live Bookkeeping customers, as of November 2021.

4. Matching: Customers are automatically matched with a Live Bookkeeper that has experience in their relevant industry, unless one is unavailable. After a customer has connected with the assigned bookkeeper, they may request to be matched with a different bookkeeper, if they prefer.

5. Collaboration: Based on a survey of QuickBooks Live Bookkeeping customers who used QuickBooks Live Bookkeeping for more than 3 months, as of November 2021.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Call Sales: 1-800-365-9606

© 2024 Intuit Inc. All rights reserved.

Intuit, QuickBooks, QB, TurboTax, Credit Karma, and Mailchimp are registered trademarks of Intuit Inc.

By accessing and using this page you agree to the Website Terms of Service.