By Ken Boyd August 5, 2020

2020 small business owner’s guide to bookkeeping

Successful businesses need financial information to control costs, manage cash flow, and generate a profit. Without reliable data, you may not be able to make the best decisions for your business. A bookkeeping system provides the information you need to manage your operations.

Read on to learn more about bookkeeping, the steps to get started, and why it’s important to your business.

What is bookkeeping?

Bookkeeping includes gathering financial data into a recordkeeping system and posting transactions to an accounting system. The definition often includes additional tasks to keep your business running smoothly. If you’re handling bookkeeping for your small business, you’ll work on several basic tasks.

What does a bookkeeper do?

If you’re acting as a bookkeeper for your business, you’ll review source documents and record basic accounting information. These are not administrative tasks. They’re critical steps that can affect your business.

You’ll post three common financial transactions to your accounting system.

1. Expenses

You’ll review vendor invoices and vendor payments and record expenses in your accounting system. Reviewing expenses can help you manage your spending.

2. Revenue

When a worker makes a sale, they post the transaction and customer number. Then you can generate financial reports to see which customers generate the most revenue.

3. Tax deductions

As your company’s bookkeeper, you may generate a tax report for your CPA. The report assigns each expense to the correct line on the company’s tax return. Reviewing tax reports can help you maximize tax deductions for your business.

Why does bookkeeping matter?

To understand the importance of bookkeeping, think about your company’s stakeholders. Investors, creditors, vendors, and regulators need accurate financial records regarding your business. Proper bookkeeping can help you provide much of that data.

Bookkeeping can help you manage tax filings

Using bookkeeping, you can record revenue and expenses and generate tax returns. If the data is incomplete or contains errors, you’ll have to amend the returns, which may result in interest and penalties.

Bookkeeping can help you make management decisions

Managers need accurate data to increase sales, manage costs, and to oversee cash flow. Using basic bookkeeping principles, you can post and access information that managers need to make decisions.

Bookkeeping can help you finance your business

Eventually, your business may need to borrow money to operate. Your lender will require accurate financial statements to fund your loan. You can use accounting transactions to generate balance sheets, income statements, and cash flow statements.

Your business may post dozens of accounting transactions each week. When you have a reliable system, you post fewer errors. And if you make a mistake, you’ll be able to correct it much faster.

4 steps for basic small business bookkeeping

1. Separate your business and personal expenses

Open a bank account using your company name and tax identification number. Activity in the business account should not include any personal expenses. Separating your expenses can protect your personal assets from business liability or a lawsuit. If your business is a corporation, for example,it should be a legal entity separate from you.

If you post business and personal transactions in the same bookkeeping system, you risk the accuracy of your financial statements and tax returns. Let’s assume that you post $2,000 in personal expenses in the company accounting records. The expenses in the income statement won’t be accurate, and your business tax return will contain errors.

2. Choose a bookkeeping method: double-entry or single-entry

Every business should use the double-entry bookkeeping method. This concept is important because each accounting transaction impacts at least two accounts. Using the double-entry method, you can get a clearer picture of your business activity. And when it’s time to post a journal entry to your accounting system, the double-entry method accounts for debit entries, credit entries, and totals.

Debit entries are on the left side of each journal entry. In most cases, asset and expense accounts increase with each debit entry. Credit entries are on the right side of each journal entry. In most cases, liability and revenue accounts increase with a credit entry. Finally, the total dollar amount of debits must always equal credits. Accounting and bookkeeping software requires each journal entry to post an equal dollar amount of debits and credits. However, the number of debit and credit entries may differ.

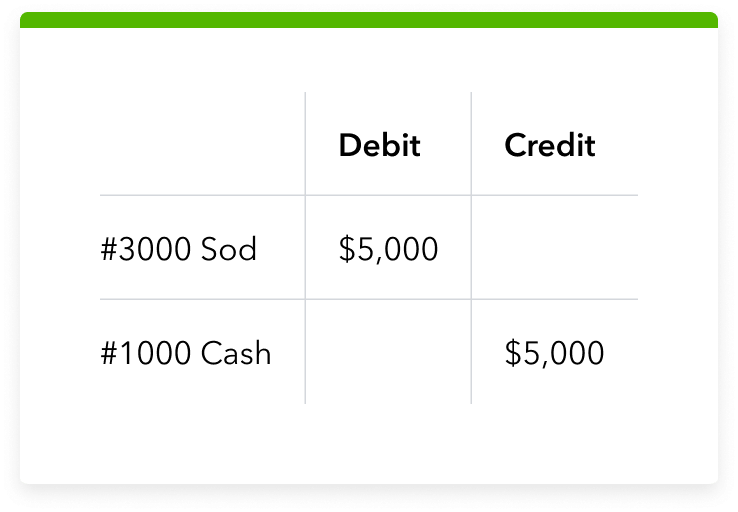

Let’s look at an example:

Riverside Landscaping purchased $5,000 of sod and paid cash. Sod is an asset account, so it increases with a debit. Cash is also an asset account, so it decreases with credit. Total debits equal credits.

Their journal entry follows:

On the other hand, the single-entry method of accounting presents a distorted view of business results. This accounting method records one entry to one account for each transaction. Posting activity to your checkbook is a single-entry accounting system. When you write a check, you post one transaction that reflects a decrease in your bank balance.

Business owners should not use the single-entry option because they can’t generate the account activity required to create balance sheets or cash flow statements. If you’re managing your business with the single-entry method, a CPA can help you move to the double-entry method.

3. Choose your accounting method: accrual or cash basis

Business owners should use the accrual basis of accounting so that their financial statements are clear and accurate. The accrual method matches revenue earned with expenses incurred to generate the revenue, which presents a clear picture of company profit.

Let’s look at an example:

– Riverside Landscaping bought $1,000 of sod in February

– Riverside Landscaping paid $2,000 in labor costs in March, and billed the Jones family $3,500 on March 20

– The Joneses paid Riverside’s invoice in April

Assuming Riverside paid $100 in overhead, you can subtract revenue and material, labor, and overhead costs to calculate their profit from the Joneses’ project. Riverside’s profit is $400.

The material, labor, and overhead costs and revenue from the landscaping job posted when Riverside performed the work. Riverside’s $400 profit posted when they billed the Joneses on March 20. When you can match revenue with expenses, you’ll know the profitability of each product or service.

On the other hand, the cash method posts revenue and expenses based on cash inflows and outflows. Using the cash method, Riverside would post $1,000 in sod expenses when they pay cash in February. Their $3,500 revenue would post when they receive cash from the customer in April.

Essentially, revenue and expense transactions would post to different months. So Riverside couldn’t look at the March income statement and see the Joneses project’s revenue and expenses. Therefore, they couldn’t determine the profit earned on that job.

4. Categorize your transactions

As you post transactions, you need to post the information to the correct accounts in your bookkeeping system consistently. Maintain an updated chart of accounts to post your accounting information to the right places.

Every business creates a chart of accounts—or a list of each account needed to manage the business and a corresponding account number. As the company grows, you may add, remove, or change the accounts you use to post transactions. For example, in Riverside’s journal entry, their cash account is #1000, and their sod account is #3000. Balance sheet accounts are numbered first, followed by revenue and expense accounts.

Free basic bookkeeping template

Download a bookkeeping template for a balance sheet, income statement, and cash flow statement for a particular business. Cash balances and net incomes link the financial statements.

In the balance sheet, the cash balance is the ending balance in the cash flow statement. In the income statement, the net income is also the retained earnings balance in the balance sheet. Net income increases retained earnings.

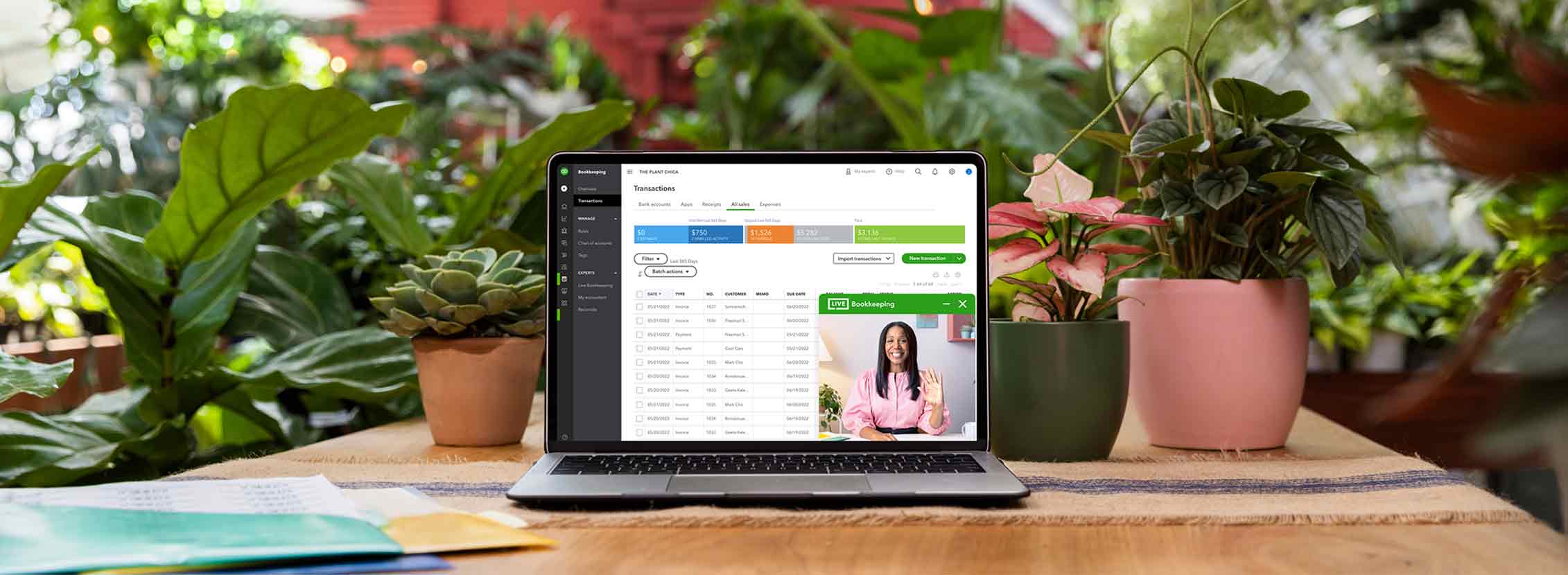

An online accounting system may provide a number of benefits that can save you time and reduce the risk of error.

3 benefits of online bookkeeping

The right accounting solution allows you to automate many basic bookkeeping tasks. As a result, you can:

1. Collect payments faster

Invoice your clients and accept payments automatically to speed up the cash collection process.

2. Capture and organize receipts

Scan and attach receipts to a transaction to eliminate paper files and stay organized for tax season.

3. Manage tax deductions

Track your expenses to maximize tax deductions for things like business mileage.

Excel bookkeeping vs. online bookkeeping

Many small businesses start accounting using Excel. However, managing your books in a spreadsheet can be time-consuming and error-prone. If not managed properly, spreadsheet tabs may not be linked or up to date. In addition, you can’t integrate spreadsheets with bank statements, credit card reports, or payroll records. And if you need someone to help you manage the books, you may find it challenging to train them in Excel. As your business grows, your small transactions also increase. If you’re posting more transactions each month, entering data can make bookkeeping more difficult.

Manage your business with Live Bookkeeping

Once you understand basic bookkeeping, you can manage your business finances with confidence. If you need help, a virtual bookkeeping service—like QuickBooks Live—can match you with a bookkeeper who understands your business or industry. They can help you manage and maintain your books accurately. Make the switch to an online solution, and you’ll be better prepared to manage company growth.

Read stories from three business owners and discover how QuickBooks Live Bookkeeping provided a boost for their small business.