All the features you need to manage trucking payroll

Manage labor costs

When you run a trucking company, you have to stay on top of driver and vehicle expenses. Keep tabs on labor costs, and view costs by fleet, driver, and more, so you’ll always know how your business is doing.

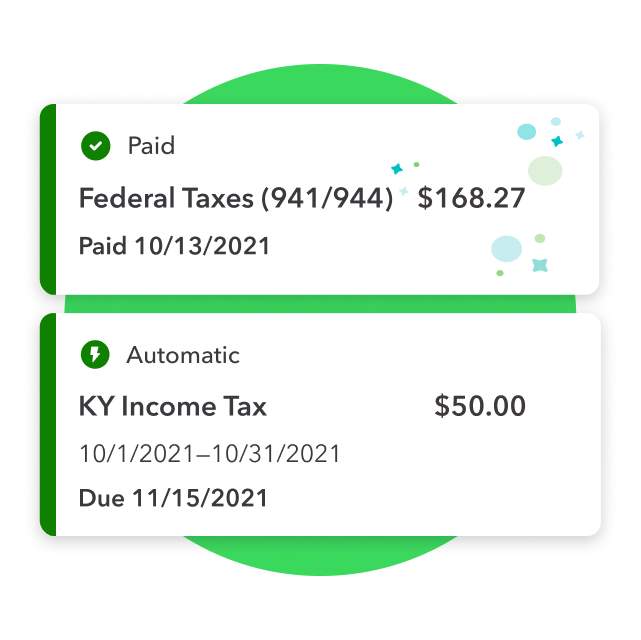

Tackle payroll taxes

Set up payroll, and we’ll calculate, file, and pay your payroll taxes automatically. All plans come with full-service payroll, including automated taxes and forms.**

Trusted time tracking

Drivers can clock in or out anywhere, on any device. GPS tracking makes it easy to see who’s working and where.**

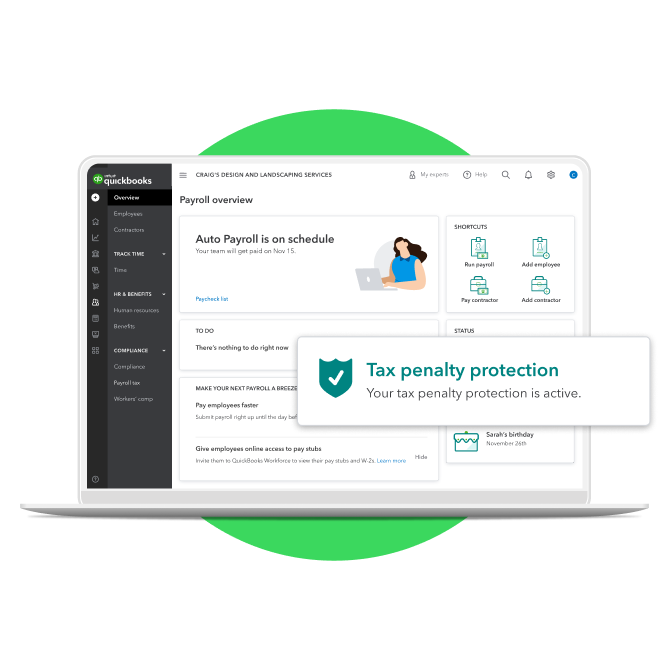

Tax penalty protection

With tax penalty protection, we’ll resolve filing errors and pay penalties up to $25,000. We deal directly with the IRS so that you don’t have to.

Same-day direct deposit

Make your drivers happy and keep money in your pocket longer with same-day direct deposit. Submit payroll up to 7 AM PT payday morning to have funds withdrawn that day.**

Workers’ comp

Help protect your transportation company and drivers with workers’ comp powered by Next. Stay compliant and never miss a payment with automated, pay-as-you-go premiums.**

Manage labor costs

When you run a trucking company, you have to stay on top of driver and vehicle expenses. Keep tabs on labor costs, and view costs by fleet, driver, and more, so you’ll always know how your business is doing.

Tackle payroll taxes

Set up payroll, and we’ll calculate, file, and pay your payroll taxes automatically. All plans come with full-service payroll, including automated taxes and forms.**

Trusted time tracking

Drivers can clock in or out anywhere, on any device. GPS tracking makes it easy to see who’s working and where.**

Tax penalty protection

With tax penalty protection, we’ll resolve filing errors and pay penalties up to $25,000. We deal directly with the IRS so that you don’t have to.

Same-day direct deposit

Make your drivers happy and keep money in your pocket longer with same-day direct deposit. Submit payroll up to 7 AM PT payday morning to have funds withdrawn that day.**

Workers’ comp

Help protect your transportation company and drivers with workers’ comp powered by Next. Stay compliant and never miss a payment with automated, pay-as-you-go premiums.**

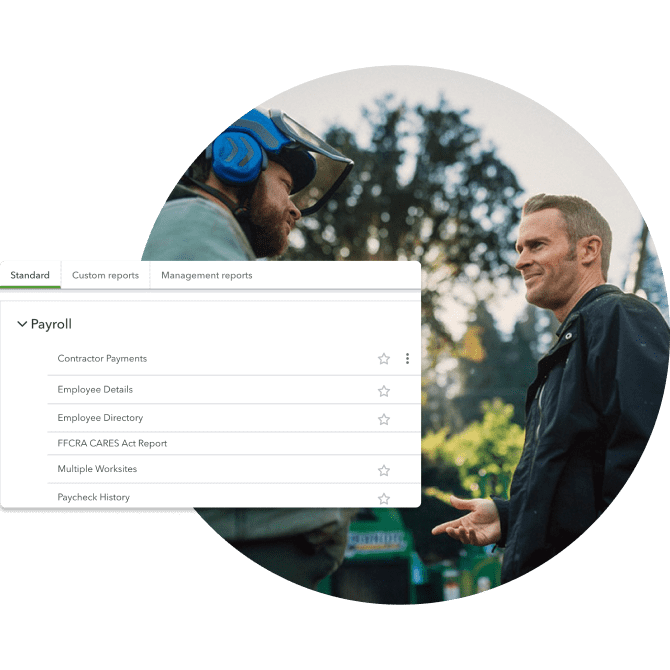

Customizable payroll reports

Take a closer look at your company’s finances and get the information you need with customizable payroll reports. Create and download reports for cash flow, contractor payments, multiple worksites, timesheet activity, and more—all from your dashboard.

Payroll for truck drivers made easy

When your drivers are spread out across the country and don’t always work set hours, payroll processing can be challenging. But QuickBooks makes payday easy. Get automatic local, state, and federal tax calculations on every paycheck. Drivers can even view their pay stubs online.** Even tax time is a breeze—automatically generate W-2s and prepare contractor 1099s in one place.

Why use QuickBooks Online Payroll for trucking companies?

Trucking companies are complex, so it’s important to choose a payroll system you trust to simplify things. QuickBooks lets you run real-time workers’ comp and tax reports showing what you’ve paid and what you owe over any date range. And with tax penalty protection, you don’t have to worry about fees or filing errors.