Step 1: Understand the 1099 form

Businesses must provide a 1099-NEC to each contractor who is paid $600 or more in a calendar year. Independent contractors must include all payments on a tax return, including payments that total less than $600. Note also that nonemployee compensation includes payments to individuals and partnerships.

A number of payments do not require a 1099-NEC, including:

- Payments to a corporation, including a limited liability company that is treated as a C corporation or an S corporation for tax purposes.

- Business travel allowances paid to employees.

- Payments for merchandise, freight, or storage.

Payments through third-party networks—including credit card payments—are reported on Form 1099-K. If, for example, a business pays an independent contractor through PayPal, the contractor may receive a Form 1099-K from PayPal for those direct sales. Issuing a 1099-K depends on the number of transactions and the total dollar amount paid.

Use accounting software to fill out a Form 1099-NEC for each contractor and consult with a certified public accountant (CPA) regarding the 1099 forms your business must provide.

QuickBooks offers 1099 e-filing services with QuickBooks Payroll1 and QuickBooks Contractor Payments. When you use QuickBooks Payroll software or Contractor Payments, Your 1099s will be automatically generated and e-filed for you, saving time and helping you prepare for tax season. You can file unlimited 1099s, including 1099-NEC and 1099-MISC2.

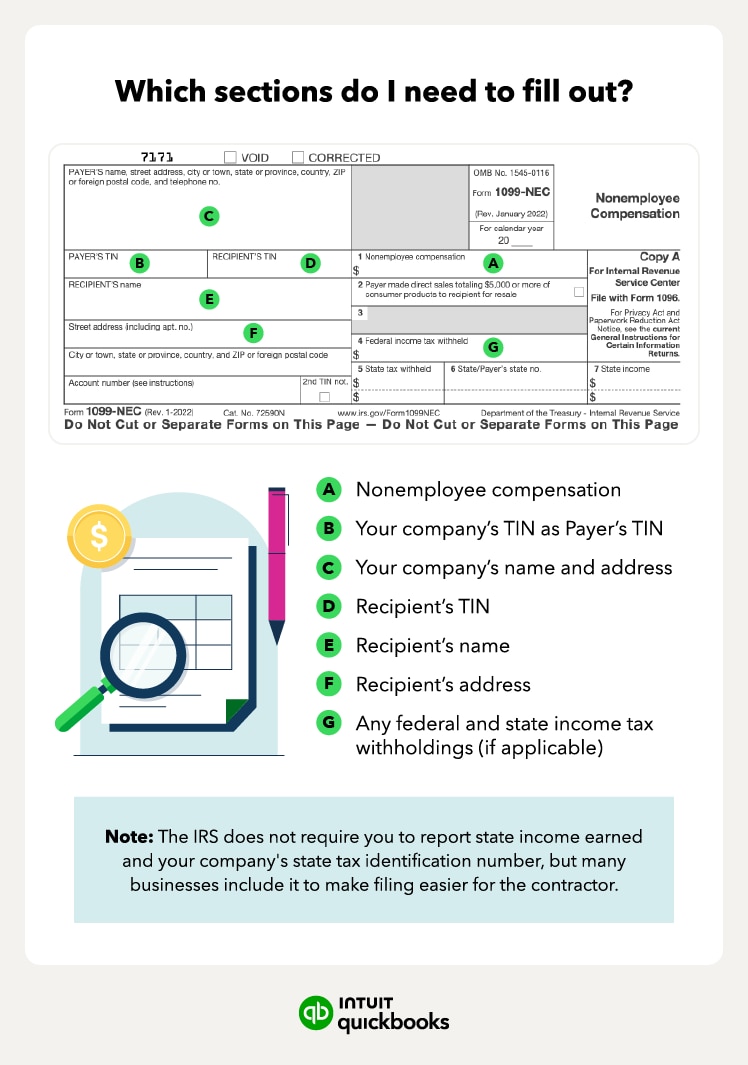

Step 2: Fill out a 1099 form

Make sure you have all necessary documents for each independent contractor you employ. Each independent contractor should have filled out a W-9 before providing any services. These provide you with the following information useful for filling out 1099s.