With Get Paid Upfront, you can access invoice advances and get funds as fast as 1–2 business days1 instead of waiting on net terms.

Explore the features

Bridge cash flow gaps until invoices are paid

Stay on top of expenses like payroll and repairs

Find peace of mind to move business forward

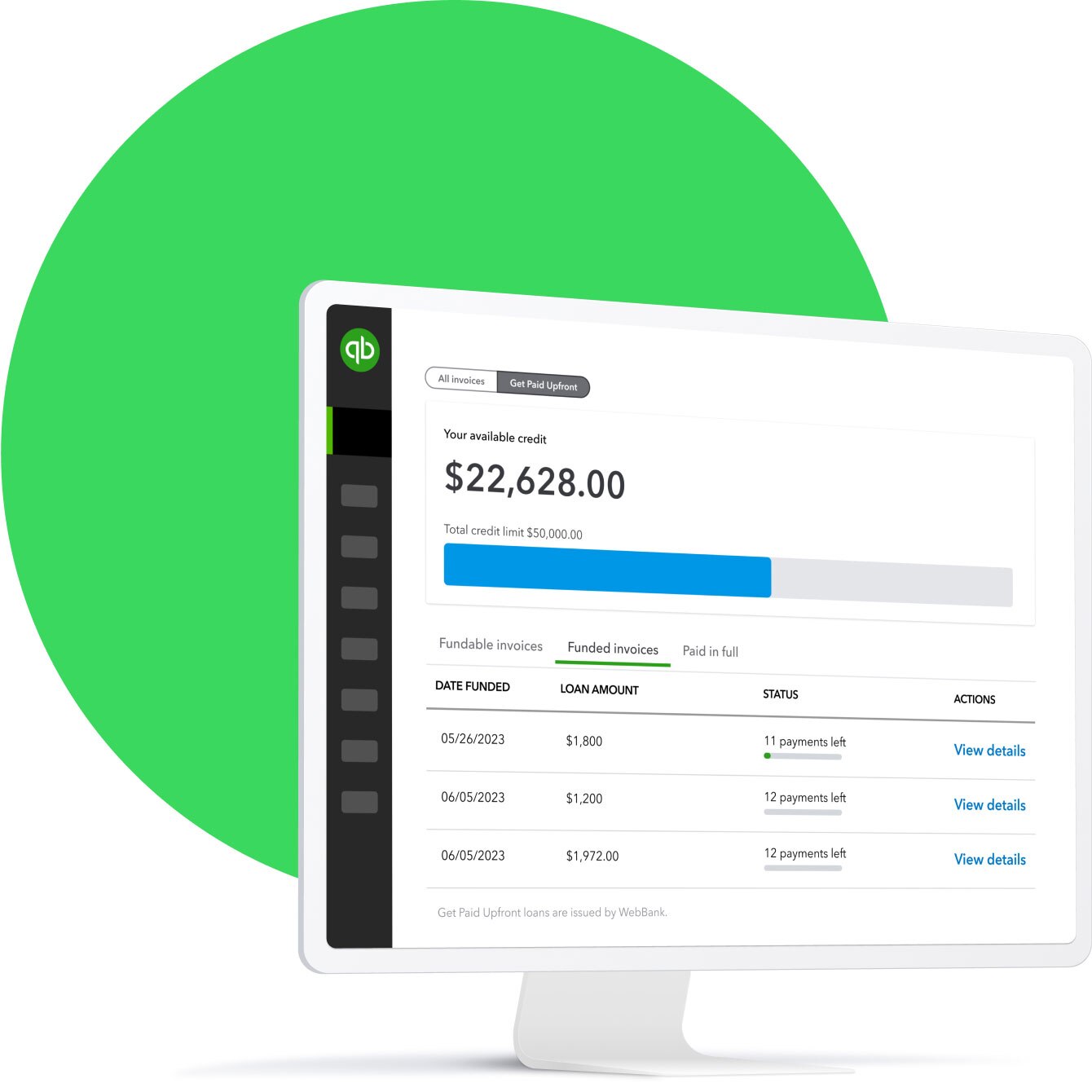

See Get Paid Upfront in action

Learn how easy it is to get started with Get Paid Upfront and to easily apply right inside QuickBooks.

Money when you need it

It feels great when customers pay immediately. But sometimes they don’t. To cover those cash flow gaps, consider accessing funds by applying for Get Paid Upfront with credit limits up to $50,000. Final offer amount may vary based on credit profile.

Time is on your side

If approved, you can access funds quickly and get back to doing what matters most.

Faster funds with more flexibility

Applying just takes minutes and doesn’t affect your personal credit score. If approved, you can access funds as fast as 1-2 business days.1

Frequently asked questions

Get Paid Upfront was made to help small businesses receive an invoice advance on their invoices (instead of waiting on net terms). With a Get Paid Upfront credit limit, you can access invoice advances and get funds as fast as 1–2 business days instead of waiting on net terms.1

You must have an active QuickBooks subscription and be a QuickBooks Payments customer to use Get Paid Upfront.

There are many factors that determine if your business is eligible for Get Paid Upfront. A few examples are your QuickBooks business history, transactions in business bank accounts, invoice history, business credit profile, and as the personal guarantor, your personal credit profile.

Sign in to your QuickBooks account and go to Invoices and then select Get Paid Upfront. When you choose to fund an invoice for the first time, you’ll fill out an application to see if you’re approved. You can also apply without an invoice. If you are approved and accept the terms, the Get Paid Upfront advance will be disbursed to you in as fast as 1–2 business days of acceptance. You’ll be assigned a total credit limit to use to fund other eligible invoices.

The application process doesn't affect your personal credit score.

Because every business is unique, each application is considered individually, and decisions are based on your credit risk profile, current guidelines, and applicable laws. Terms and credit limits may change over time.

Your offer can be modified or revoked at any time, for any reason. These reasons can include, but aren’t limited to, if something changes with your business or personal credit profile, irregularities with your business or identity, or if you cancel or suspend your QuickBooks Payments account.

For invoices that qualify, here’s the process:

- When you send an invoice, you can choose to get it funded early. Go to Invoices, and select Get Paid Upfront to see your eligible invoices. Then select Get it funded.

- The invoice amount, minus any upfront fee (up to 3%, as detailed in your loan agreement), will be deposited into the business bank account you have provided in your application, after you’ve been approved for, and accepted the offer. The money should appear in your account within 1–2 business days of acceptance. We'll deduct the invoice total from your assigned credit limit to determine your remaining available credit, which you can use to fund additional eligible invoices.

- Interest may accrue on outstanding loan balances, per the terms of your loan agreement. If your customer pays their invoice through QuickBooks Payments during the first 30 days, those payments are applied automatically to your Get Paid Upfront balance.2

- You can repay the total invoice amount in 12 monthly installments at a fixed interest rate (per your loan agreement).

Please see your loan agreement for specific terms and additional details.

Get Paid Upfront lets you fund multiple eligible invoices that meet certain criteria, for example:

- You sent the invoice through QuickBooks

- You have enough available credit remaining

- The invoice total is $258 or more

- The invoice isn't more than 30 days past due

Each advance is treated and documented as a separate loan according to its own unique terms.

Credit limits and interest rates for Get Paid Upfront may be affected by things like:

- Business performance

- Repayment history

- Credit usage

- Various other factors

Credit limits and interest rates are subject to change based on various credit factors and market conditions. The interest rate is set when you select an invoice to finance. This means the interest rate can change for each financed invoice.

- If your credit limit increases, it means you’re generally doing great at continually meeting the established credit requirements. This lets you take advantage of more invoice advances, if you need them.

- With a credit limit decrease, focus on things like building a better track record. Repaying Get Paid Upfront loans on time may increase the chance of getting a higher credit limit in the future.

Connect all your business bank accounts to QuickBooks so you can get more tailored offer(s) for Get Paid Upfront advances.

Get Paid Upfront lets you keep a direct relationship with your customers and doesn't interfere with your customer relationships. They won't even know you use it.

Interest may accrue on outstanding loan balances per the terms of your loan agreement. When your customer pays their invoice through QuickBooks Payments during the first 30 days, the payment will be automatically applied to your Get Paid Upfront balance. You can take advantage of autopay to repay the loan. Each month, the pre-authorized monthly repayment amount will be debited from the same business bank account where your upfront advance was sent.

You can also make manual payments. Sign in to your QuickBooks account and go to Invoices and then select Get Paid Upfront. You can view, manage, and repay your upfront advances.

There are no prepayment penalties if you prepay your loan in full or in part.

Your loan transaction history with QuickBooks, which includes failure to repay on time, may be reported to Experian Small Business Credit Share and Dun & Bradstreet.

Each Get Paid Upfront loan requires a personal guarantee. The personal guarantor may have to repay the loan in full, in the event the business is unable to. This is common for many small business loans.

The lender reserves the right to revoke or limit access to your credit limit if one or more of your loans become delinquent.

You may be able to restore access to your credit limit if you pay the past due amount. Once you make the payment, it can take up to 3 business days before you can use Get Paid Upfront again.

To change your payment method, call 877-223-4710, Monday–Friday, 6:00 AM to 3:00 PM, PT. You can choose to pay with a check, money order, or wire transfer. Note the disbursement date of your loan for easy reference.

You can also send payments by check. For regular mail, use this address: Intuit Financing Inc., P.O. Box 842978, Dallas, TX 75284-2978. For express or overnight delivery, use this address: Bank of America Lockbox Services Infomart, Lockbox 842978, 1950 N. Stemmons Fwy., Suite 5010, Dallas, TX 75207.

Note: We consider payments received after 4:30 PM Pacific Time (PT) on weekdays to be made on the next business day.

If you have additional questions about Get Paid Upfront, call us at 877-223- 4710 or email Servicing@intuit.com.

Get Paid Upfront loans are issued by WebBank.

Start getting paid on your terms

Get Paid Upfront loans are issued by and subject to approval by the lender, WebBank. QuickBooks Payments enrollment required.

All screen images are simulated and are for illustration purposes only.

- Loans are typically deposited within 1–2 business days. Actual funding time can vary depending on third party processing time.

- This feature isn’t available for customer invoice payments made through GoPayment, Pay links, or QuickBooks Online Receive Payment experience.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Call Sales: 1-877-683-3280

© 2024 Intuit Inc. All rights reserved.

Intuit, QuickBooks, QB, TurboTax, Credit Karma, and Mailchimp are registered trademarks of Intuit Inc.

By accessing and using this page you agree to the Website Terms of Service.