Congratulations on getting your Standard Payroll setup. Now comes the fun part: paying employees!

Before you can run payroll, especially if this is your first time running payroll, make sure you:

- register as an employer with HMRC to receive your PAYE reference number, Accounts Office reference number, Government Gateway user ID and password

- turn on Standard Payroll and Real Time Information (RTI) reporting

- complete the setup for all of your employees. If an employee is marked as incomplete on the employee list, you can go into their settings to check and edit their details so that they’ll show up as complete

When you’re all set up to run payroll, you’ll see Complete next to Payroll Status and RTI Status. We’ll also show you what happens after you run payroll. Let’s get started!

Step 1. Create a pay run

- Go to Payroll and select Employees (Take me there).

- Check the pay date. You can select the calendar icon to change when your employees get paid. Remember, the pay date must be within the tax period.

- Using the toggle, select all the employees you want to pay. Only employees you've finished setting up will show as available in the list. You can complete the employee setup from here, just select Complete setup.

Step 2. Add salary, additional payments or deductions

- Select Edit next to the employee to enter or change the employee's salary.

- To add additional pay types like overtime, bonus, car allowance and more, select Add/edit bonus or other payment.

- To add after-tax deduction, loan repayment or advanced repayments and more, select Add/edit deduction.

- Select Done.

Step 3. Review and submit payroll

- Select Review payroll to see a summary of this pay run.

- Select the Net Pay amount to see a draft of the employee's payslip and review their salary, National Insurance contributions, PAYE. You can also download their payslip from here too.

- Tip: You can use HMRC's PAYE and NI calculator to check things over. See any problems? Go back and make any changes before you submit the payroll.

- Once you're happy with the pay run, select Confirm and submit to create the payroll in QuickBooks.

- Tip: To see a complete breakdown of the pay run, select View breakdown under the payroll total.

After you run payroll QuickBooks automatically creates a journal entry for the pay run in the background for you. You won't be able to customise the entries but you can choose which Net pay account and manually edit them once they're posted. Use the search tool in QuickBooks to find journals and transactions.

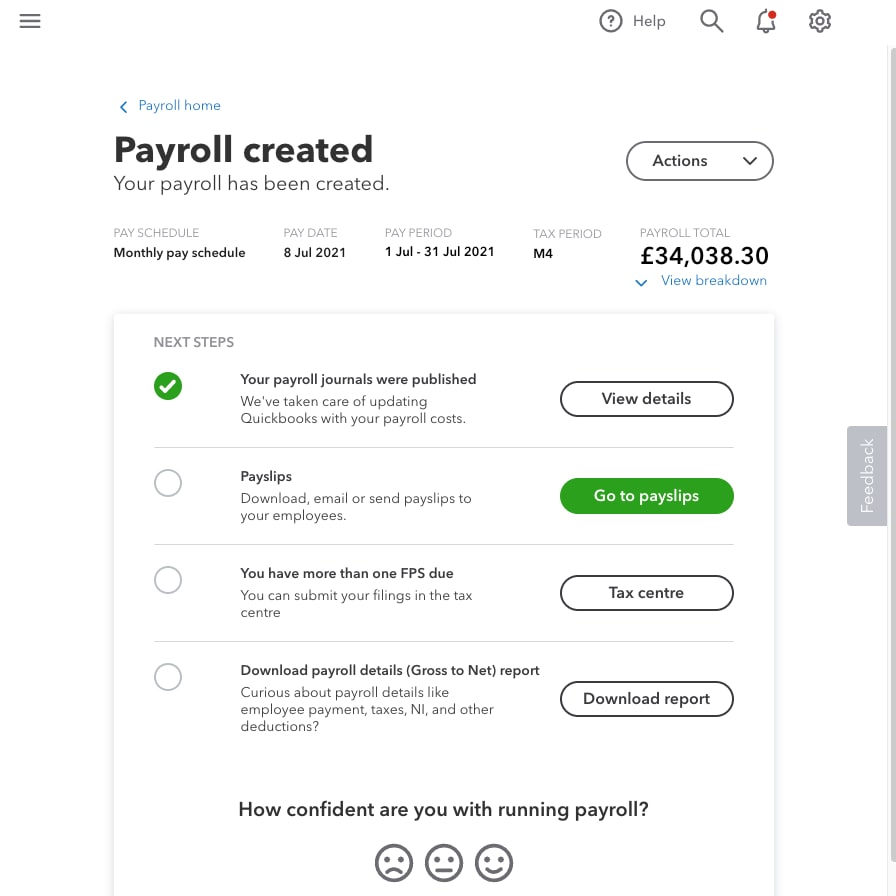

What happens next?

Next, you need to send the information to HMRC by submitting a Full Payment Summary (FPS) before or on the day you pay your employees. If you have RTI switched on, you don't need to manually submit anything.

Then it's time to give your employee's their payslips. A safe and secure way to do this is through the QuickBooks Workforce. Employees can sign in to view and download their payslips from anywhere at their own convenience.

And the final step is paying HMRC any payroll liabilities that are owed for the given tax month. You can find the amount due in the Employee Payment Report (P32), which can be found under the Reports tab.