Reviews that speak volumes

Discover what makes QuickBooks Online the #1 accounting software for small businesses.2

★★★★★

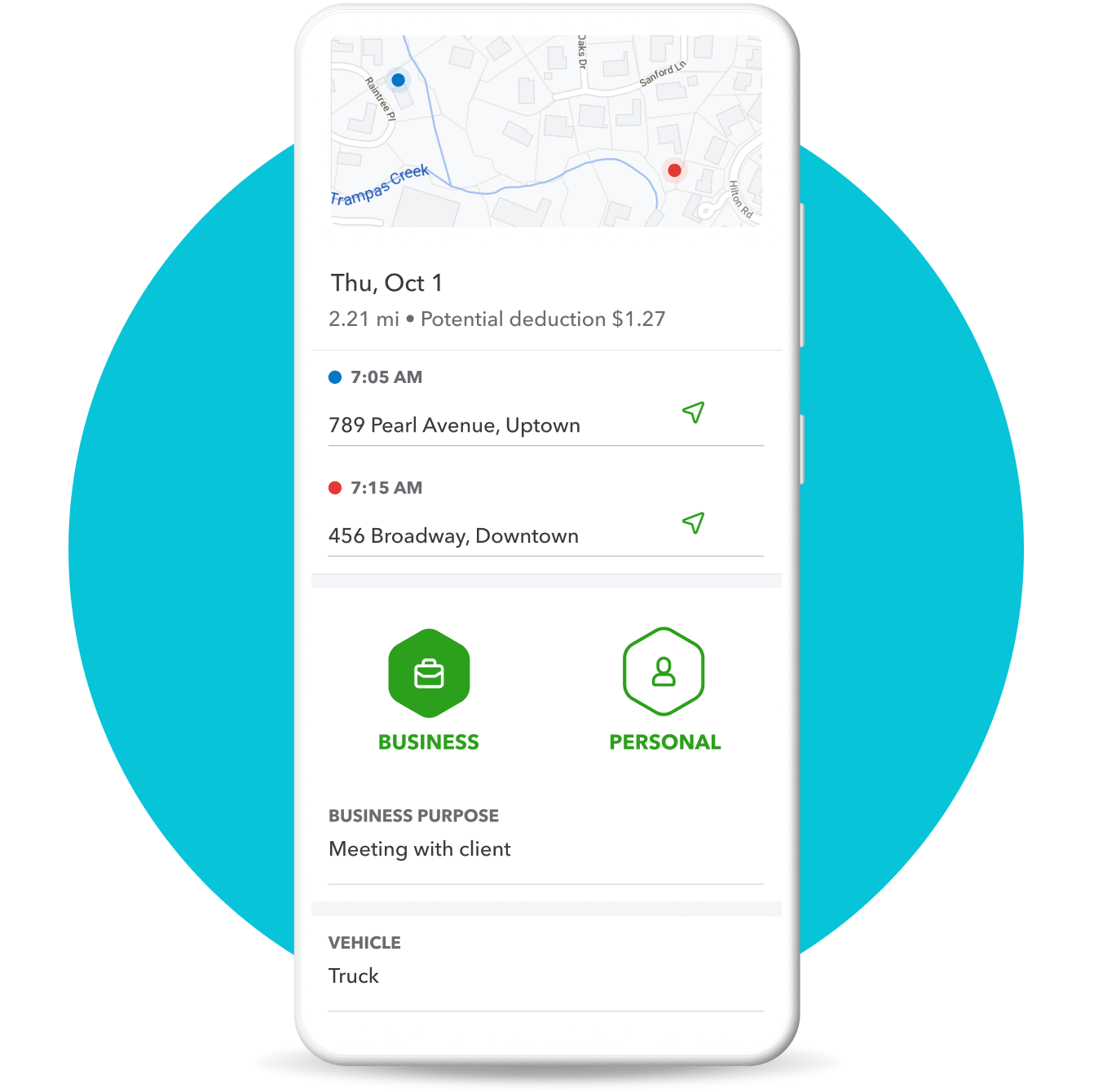

The app allows me to track business mileage and convert it directly into tax deductions.

★★★★★

I like how easy it is to use Quickbooks, you can set rules for an item to automatically be added to a certain category for tax deductions.

More tax deductions, more money in your pocket

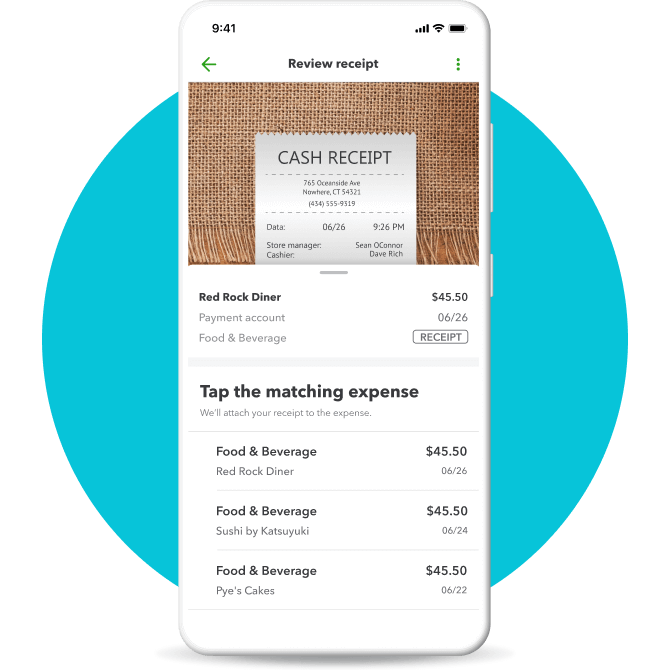

QuickBooks matches receipt photos to transactions and sorts them into tax categories automatically. Staying organized has never been easier.**

Maximize every moment on the road with automatic mileage tracking. Quickly sort business from personal trips to save more during tax season.**

Good-bye manually entering deductible expenses. Connect bank, credit card, and other accounts to automatically pull in all your business expenses.**

The simple way to stack up deductions

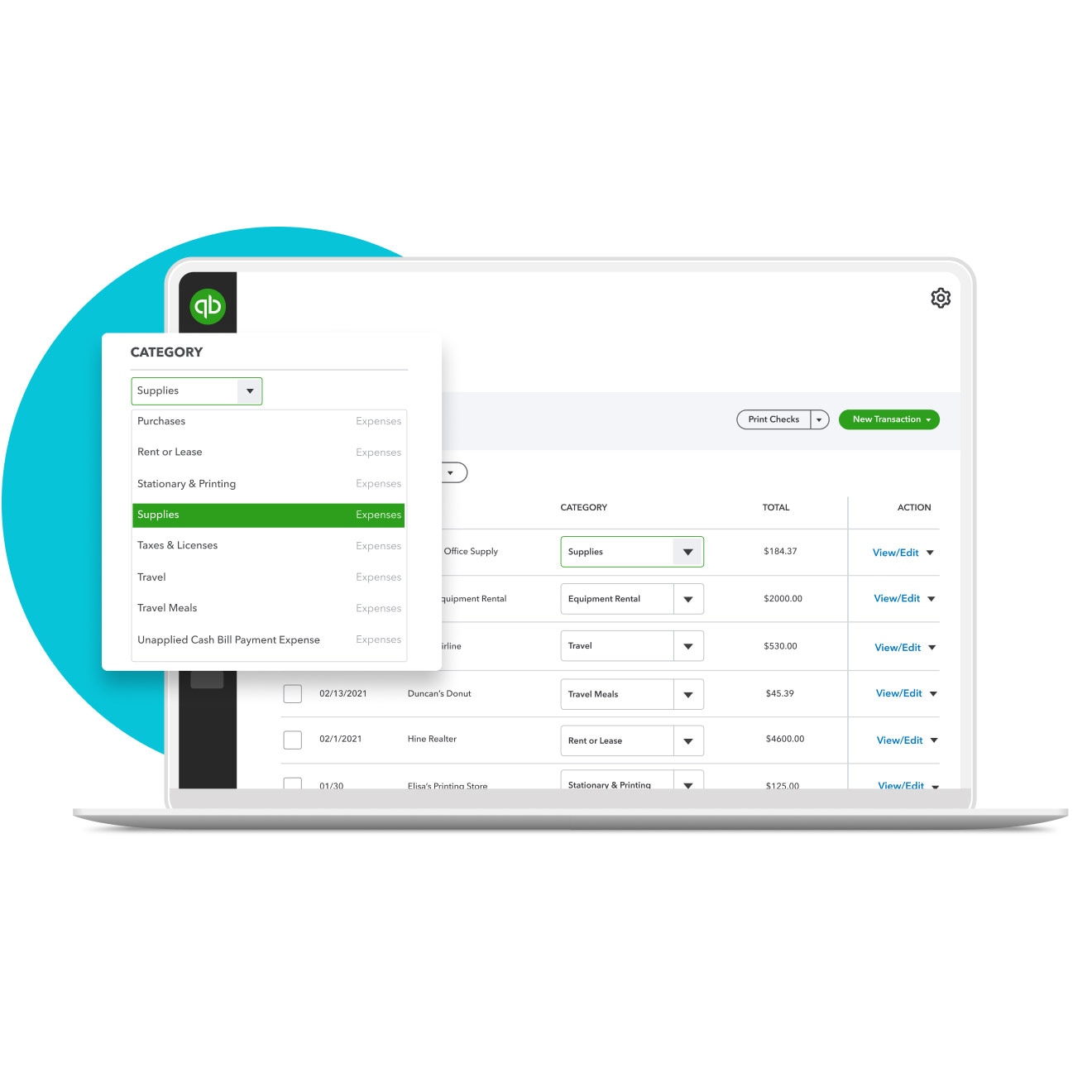

Categorize expenses automatically

Use our tax categories, or set up your own, so that your business expenses are sorted automatically and ready to use at tax time.

Automatic tax calculations

Avoid year-end surprises with our automatic quarterly tax calculations that helps you know how much money to set aside.

Organized tax-time documents

No more scramble to get ready to file. Reports and documents are on stand-by to help you find those deductions.

Stay on top of your sales tax

You can view your sales tax information any time with the Sales Tax Liability Report. This on-demand report will keep you up-to-date on your taxable and nontaxable sales, all broken down by tax agency.

Plans for every kind of business, including expert tax help

Now with Live Assisted Bookkeeping (add $50/month)

- Add $50 per month

- Add $50 per month

- Add $50 per month

- Add $50 per month

NEW

NEW

Get help from our bookkeepers when you need it. They’ll provide guidance, answer your questions, and teach you how to do tasks in QuickBooks, so you can stay on track for tax time and run your business with confidence.

QuickBooks-certified bookkeepers can help you with:

- Automating QuickBooks based on your business needs

- Categorizing transactions and reconciling accounts correctly

- Reviewing key business reports

- Ensuring you stay on track for tax time

Add $50/month

More ways to learn about tax deductions

Find more of what you need with these tools, resources, and solutions.