Give customers many ways to pay

Right through the invoice

Send your customers invoices they can pay online right away.**

On site or in store

Get paid in person with the GoPaymentNot included with QuickBooks Money app & card reader.**

Get chargeback protection

We’ll take care of chargebacks so you don’t have to. Get automatic payments dispute protection on credit and debit card disputes. We’ll even cover up to $25,000 per year—$10,000 per dispute on card payments.**

Not included with QuickBooks Money

Make payments more predictable

Track and schedule invoices that your customers can pay online, and see deposits fast.

Real-time tracking

Don’t wonder where your money is. You’ll know when customers view and pay your invoices.

Schedule ahead of time Tipping and recurring invoicing not included with QuickBooks Money.

Automate recurring invoices and give your customers the option to set up autopay.

Payments go to the bank

With a QuickBooks Checking account, eligible payments are deposited sooner, fee-free.**

Bookkeeping without the busywork

Online payments are automatically recorded in QuickBooks Online. Avoid tedious upkeep, knowing your bottom line is accurate.**

Pick the best plan for your business

Pay and get paid your way. If you need to manage your accounting too, we’ve got you covered.

Already a QuickBooks customer? Access money features

Keep more of what you make

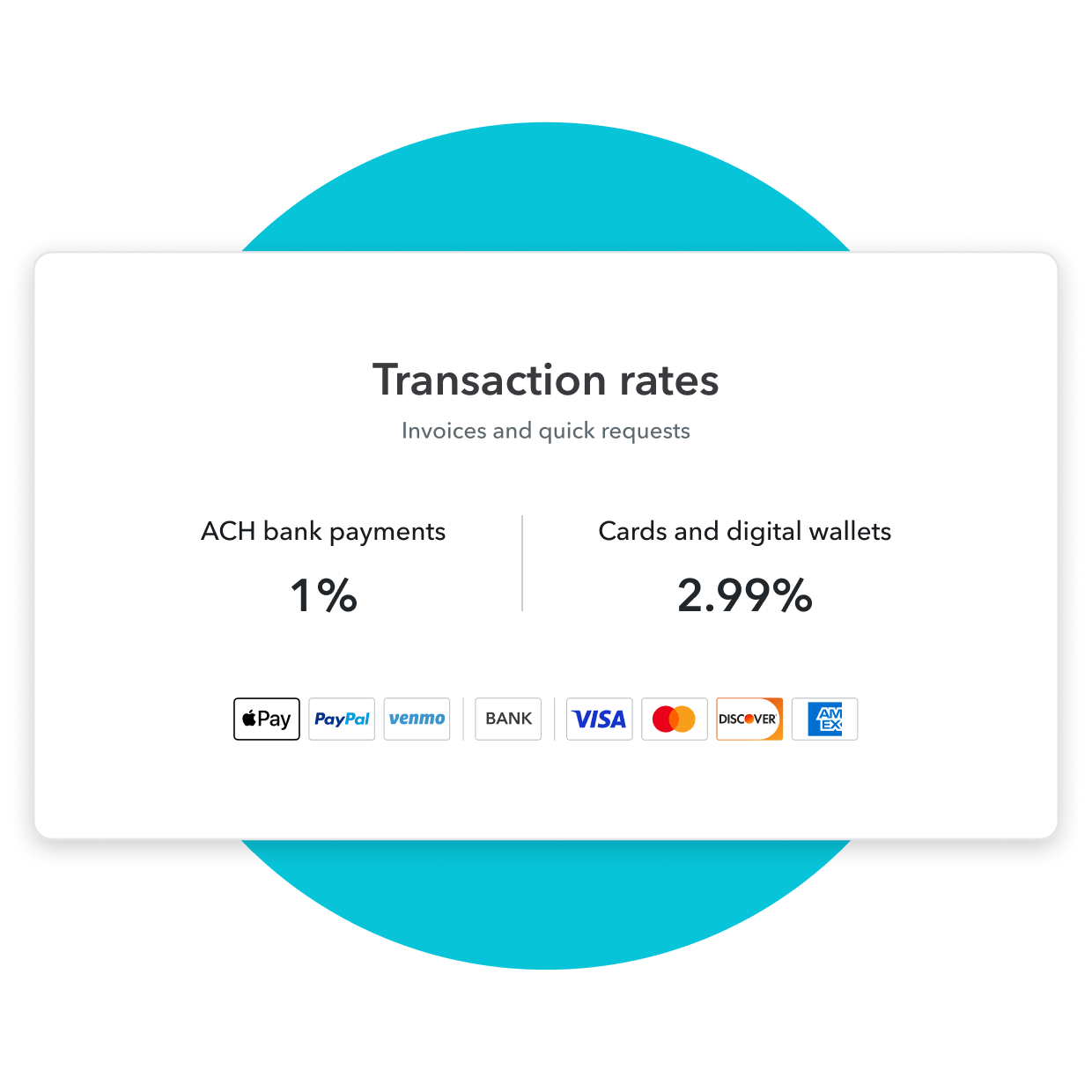

QuickBooks makes getting paid easier. Get competitive payment rates without monthly fees or minimums—just pay as you go.

If you process more than $2,500 per month, call us to see if you’re eligible for lower rates.

Grow your money with 5.00% APY**

Access your payments faster with a QuickBooks business bank account, earn 5.00% APY with savings envelopes, and manage your cash flow with ease.

QuickBooks customer paid for their time

Build your knowledge

How to choose the best payment method

What’s the best payment method for small businesses? That all depends on a variety of factors.

Everything you need to know about electronic payments

Electronic payments are when a customer pays electronically, rather than exchanging physical cash or a paper check.

Frequently asked questions

Sign up for QuickBooks and get approved as a merchant to streamline accepting payments to your bank accounts.

To start accepting payments using QuickBooks Money, install the mobile app, or sign up online. Create an account and complete an application for banking and payments. If approved, you can start accepting payments through QuickBooks Money.

For Quickbooks Online, install the mobile app or sign up for a QuickBooks Online plan from your browser. Create an account, and complete a payments application. If approved, you can start accepting payments through QuickBooks Online. You’ll also have the option to apply for a business banking account.

There are many ways to take payments through QuickBooks. With QuickBooks, you can:

- Send an instantly payable invoice that your customers pay online using a credit card, debit card, ACH bank payment, Apple Pay, PayPal, or Venmo.

- Use our QuickBooks GoPayment mobile app and card reader to accept credit or debit cards in person by tap, dip, or swipe, or via digital wallet on your customer’s device.

- Take bank transfers, including eChecks.

- Key in customer credit or debit card numbers over the phone.

If you’re using QuickBooks Money, you can use QuickBooks GoPayment mobile app and card reader as a standalone solution for in-person payments, but keyed-in transactions and POS transactions won’t sync with QuickBooks Money.

- Instant deposit for 1.75% more

- Checking with no-cost instant deposit

- Payments Dispute Protection

QuickBooks Money helps you manage your payments and banking, whereas QuickBooks Online also includes accounting tools like automatic transaction mapping, mileage tracking, bill pay, receipt capture, reporting, access to experts, and more. To see all of your options, check out the plans page.

We’re here to help. Check out the options below to find the support you need:

- Explore help articles

- Talk to someone at 800-446-8848

- Chat with us online

- For help with QuickBooks Money, reach out through the QuickBooks Assistant from the app.

Yes! Find QuickBooks Desktop rates and more information, here.

Try digital payments, no monthly fees

With QuickBooks Money, you can try money management tools without the commitment.

QuickBooks and Intuit are a technology company, not a bank. Banking services provided by our partner, Green Dot Bank, Member FDIC.

Limited time offer terms

Discount: Discount applied to the monthly price for the QuickBooks Products is for the first 3 months of service, starting from the date of enrollment, followed by the then-current monthly list price. To be eligible for this offer you must be a new QuickBooks customer and sign up for the monthly plan using the “Buy Now” option.

**Product Information:

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Online required. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

QuickBooks Money: QuickBooks Money is a standalone Intuit offering that includes QuickBooks Payments and QuickBooks Checking. Intuit accounts are subject to eligibility criteria, credit, and application approval. Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A., Inc. Visa is a registered trademark of Visa International Service Association. QuickBooks Checking Deposit Account Agreement applies. Banking services and debit card opening are subject to identity verification and approval by Green Dot Bank. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

QuickBooks Checking account: Banking services provided by and the QuickBooks Visa® Debit Card is issued by Green Dot Bank, Member FDIC, pursuant to license from Visa U.S.A., Inc. Visa is a registered trademark of Visa International Service Association. Green Dot Bank operates under the following registered trade names: GoBank, GO2bank and Bonneville Bank. Registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage up to the allowable limits. Green Dot is a registered trademark of Green Dot Corporation. ©2022 Green Dot Corporation. All rights reserved. QuickBooks products and services, including Instant Deposit, QuickBooks Payments, Cash flow planning / forecasting are not provided by Green Dot Bank.

QuickBooks Card Reader: Data access subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance. Product registration and QuickBooks Payments account required. Terms, conditions, and features subject to change.

Apple Pay: Apple Pay is a registered trademark of Apple Inc.

Google Pay: Google Pay is a trademark of Google LLC.

PayPal and Venmo: Not currently available on invoicing through QuickBooks Online Advanced subscription.

**Features:

Automatic matching: QuickBooks Online will only match bank deposits with transactions processed through QuickBooks Payments. Not all transactions are eligible and accuracy of matches is not guaranteed.

Pay-enabled invoices: Requires a separate QuickBooks Payments account which is subject to eligibility criteria, credit and application approval. E-invoicing QuickBooks Payments is an optional fee-based service. Additional fees may apply. Additional terms and conditions apply.

Instant deposit is an additional service offered by QuickBooks Payments subject to eligibility criteria, including delayed eligibility for new users and availability for only some transactions and financial institutions. The service carries a 1.75% fee in addition to standard rates for ACH, swiped, invoiced, and keyed card transactions. This 1.75% fee does not apply to payments deposited into a QuickBooks Checking account. Deposits are sent to the financial institution or debit card that you have selected to receive instant deposits in up to 30 minutes. Transactions between 2:15 PM PT and 3:15 PM PT are excluded and processed the next day. Deposit times may vary due to third party delays.

Same-day deposit: Same Day Deposit allows you to have near-real time deposits sent to you on a predetermined daily schedule (up to 3x a day, Monday through Sunday, including holidays). Same Day Deposit is an additional service offered by QuickBooks Payments subject to eligibility criteria, for no extra fee for QuickBooks Money users. QuickBooks Money payment request fees apply for ACH and card transactions. Once batched, eligible deposits will be sent to your QuickBooks Money account, and will be available in up to 30 minutes. Transactions between 2:15-3:00 pm PST are excluded and transactions after 9:00 pm PST will be available for deposit the following morning. Deposit times may vary for third party delays.

Next-day deposit: Next-day deposit feature subject to eligibility criteria. Payments processed before 3:00 PM PT typically arrive at your bank the next business day (excluding weekends and holidays). Deposit times may vary for other payment methods, third party delays or risk reviews.

Automatic sales tax: Underlying sales tax rates are estimated based on the location information associated with each individual transaction. Additional factors that may impact sales tax rates include product type, date, and customer type. Tax information needs to be validated prior to submitting to the IRS.

Business network: The AP Automation feature is not available for Simple Start customers. Use of the QuickBooks Business Network for spam, marketing, or other activities which violate applicable Intuit Terms of Service is strictly prohibited. You may only view and connect with other QuickBooks Business Network members located in your geography. All Business Information is provided by QuickBooks Online customers and is not independently verified or endorsed by Intuit. Intuit reserves the right to limit your use of the QuickBooks Business Network, including your ability to connect with other members and be listed in the network per our Intuit Terms of Service.

Payment Dispute Protection: Payments Dispute Protection ("PDP") is an additional service that covers you for certain payment disputes (i.e. "chargebacks") that your customer initiates through its card issuer associated with a credit or debit card transaction on the American Express, Discover, Mastercard or Visa networks and are processed by QuickBooks Payments while you are enrolled in PDP. You must be enrolled in PDP when both the customer's payment is processed and payment dispute is initiated to receive coverage. Payment disputes covered by PDP are subject to a per-payment dispute coverage limit of $10,000 with a total annual coverage limit of $25,000 for all payment disputes received on a rolling 365-day period. Payment disputes related to transactions processed by QuickBooks Payments prior to 3 PM PT on your enrollment day will not be covered if you enrolled in PDP after 3 PM PT. The PDP service fee ranges from .99% to 1.99%, based on eligibility criteria. Terms, conditions, and service fee subject to change without notice.

QuickBooks Checking:

Annual percentage yield: The annual percentage yield ("APY") is accurate as of July 31, 2023 and may change at our discretion at any time. An interest rate of 1.75% will be paid on the average daily available balances distributed across your created envelopes within your primary QuickBooks Checking account. Balances held outside an Envelope, will not earn interest. At the close of each statement cycle, interest is calculated based on the average daily balance in your Envelopes. The average daily available balance is calculated by adding the available balance in your Envelopes and dividing that figure by the number of days in the statement cycle. The interest earned will be distributed to each Envelope in proportion to the average daily balance of each Envelope. See Deposit Account Agreement for terms and conditions.

Envelopes: You can create up to 9 Envelopes within your primary QuickBooks Checking account. Money in Envelopes must be moved to the available balance in your primary QuickBooks Checking account before it can be used. Envelopes within your primary QuickBooks Checking account will automatically earn interest once created. At the close of each statement cycle, the interest earned on funds in your Envelopes will be credited to each Envelope in proportion to the average daily balance of each Envelope. See Deposit Account Agreement for terms and conditions.

National average interest rate: The average interest rate is based on the Federal Deposit Insurance Corporation's national rate published the week of August 15th, 2022. Learn more.

No minimum balances or monthly fees: There are no minimum balance requirements to open or maintain this account or obtain the listed APY. Other fees and limits apply. See Deposit Account Agreement for details.

Cash flow planner: Cash flow planning is provided as a courtesy for informational purposes only. Actual results may vary.

Fee-free ATM withdrawals: Fee-free ATM access applies to in-network AllPoint ATMs only (up to 4 withdrawals per statement cycle). For out-of-network ATMs and bank tellers, a $3 fee will apply, plus any additional fees charged by the ATM owner or bank. See app for fee-free ATM locations.

Bill Pay: QuickBooks Bill Pay is an additional product capability to QuickBooks Payments that may require a separate subscription. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

Mobile Remote Deposit Capture: Limited availability to existing customers on iOS and Android. Features may be more broadly available soon, but represents no obligation and should not be relied on in making a purchasing decision. Mobile deposits may take up to 5 business days. Limits on the dollar amount(s) and/or number of checks that may be deposited may apply. QuickBooks Checking account's Deposit Account Agreement applies.

# Claims

1. Over 70x U.S. average APY: Average interest rate: The average interest rate is based on the Federal Deposit Insurance Corporation's national rate published the week of October 16, 2023. Learn more.

2. Get paid 4x faster: Four times faster based on U.S. customers using QuickBooks Online invoice tracking and payment features, compared to customers not using these features, from Aug 2022 to Jul 2023.

3. Batch invoicing and Create Invoices 37% faster: Based off of tests comparing QuickBooks Online regular invoice workflow with QuickBooks Online Advanced multiple invoice workflow. QuickBooks Online Advanced supports the upload of 1,000 transaction lines for invoices at one time. Number of invoices imported depends on the number of transaction lines in the .CSV file. Customers received remuneration for participating in the tests.

Terms, conditions, pricing, special features, and service and support options subject to change without notice.

Call Sales: 1-877-683-3280

© 2024 Intuit Inc. All rights reserved.

Intuit, QuickBooks, QB, TurboTax, Credit Karma, and Mailchimp are registered trademarks of Intuit Inc.

By accessing and using this page you agree to the Website Terms of Service.